Loading

Get Ma Dor 355s 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR 355S online

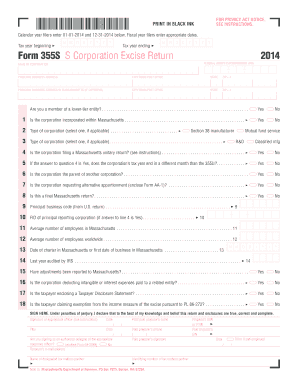

Filling out the MA DoR 355S form online can streamline the process of submitting your S corporation excise return. This guide provides a clear, step-by-step approach to effectively complete the form, ensuring all necessary information is accurately provided.

Follow the steps to successfully complete the MA DoR 355S online.

- Click the ‘Get Form’ button to acquire the form and access it in your preferred editing tool.

- Enter the calendar year or fiscal year dates in the specified fields as either '01-01-2014' and '12-31-2014' for calendar year filers or the appropriate dates for fiscal year filers.

- Complete the 'Federal Identification Number (FID)', 'Name of Corporation', and 'Principal Business Address' fields. Ensure that the address is accurate, including city/town, state, and ZIP code.

- If the principal business address in Massachusetts is different, provide that information as well in the relevant fields.

- Respond to the questions regarding membership in lower-tier entities and whether the corporation is incorporated in Massachusetts by marking 'Yes' or 'No' as applicable.

- Select the type of corporation based on the provided options, ensuring to check all applicable types.

- Indicate if the corporation is filing a Massachusetts unitary return and provide any necessary details regarding tax year end differences if applicable.

- Fill in the 'Principal Business Code', 'Average Number of Employees', and 'Charter Dates' in Massachusetts as required.

- Provide any additional information as applicable, such as adjustments reported to Massachusetts or deductions for expenses paid to related entities.

- After entering all information, review the form carefully to ensure accuracy, then proceed to save changes, download, print, or share the form as needed.

Complete your MA DoR 355S form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, the post office does not carry Massachusetts state tax forms like the MA DoR 355S. However, many branches may have limited supplies of popular tax forms during tax season. For a complete set of forms, visit the Massachusetts Department of Revenue's website or local government offices.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.