Loading

Get Pr As 2645.1 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR AS 2645.1 online

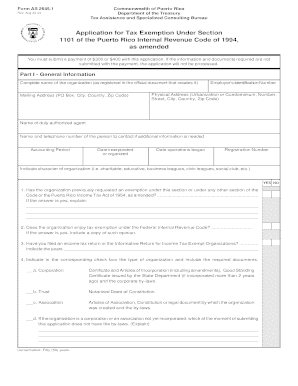

Filling out the PR AS 2645.1 is an essential step for organizations seeking tax exemption under the Puerto Rico Internal Revenue Code. This guide will provide you with detailed, step-by-step instructions to complete the form online, ensuring that you submit the necessary information accurately and efficiently.

Follow the steps to complete the PR AS 2645.1 online

- Use the ‘Get Form’ button to access the PR AS 2645.1 document. This will enable you to open the form for editing.

- Begin with Part I - General Information. Provide your organization's complete name as registered in the official creation document, including your mailing and physical address, and the Employer Identification Number.

- Fill in the name of the duly authorized agent and provide their contact information, including a phone number for additional inquiries.

- Indicate the accounting period, date of incorporation, date the organization began operations, and the registration number.

- Identify the character of the organization by selecting among options such as charitable, educational, business leagues, etc. Answer the yes/no questions regarding previous exemption requests and federal tax exemption status.

- For organizations requesting exemption, provide necessary documentation based on your organization type: corporation, trust, or association, including incorporation certificates and bylaws as needed.

- Move to Part II - Information Concerning Activities and Operations. Describe the past, current, and future activities of your organization in detail, noting their significance and purpose.

- List the sources of income for your organization and detail any programs set up to collect funds.

- Indicate how income and surplus are utilized within the organization, ensuring clarity on financial distributions.

- Complete and provide details concerning the board of directors, including names and annual compensation. Answer questions about control over other entities.

- Indicate if any assets are held under management agreements and describe the disposition of assets in case of dissolution.

- Finalize the form by declaring and signing it under penalty of perjury. Ensure all necessary signatures are included.

- Once completed, save your changes. You can choose to download a copy, print it out for submission, or share it with relevant parties.

Start completing your PR AS 2645.1 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The standard filing fee for Form 1023 will cost you $750, but your fee will be reduced by $400 if you don't expect revenue to exceed $40,000. The financial considerations involved in starting a nonprofit require a lot of legwork and more than a little paperwork, but you will be rewarded with financial security.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.