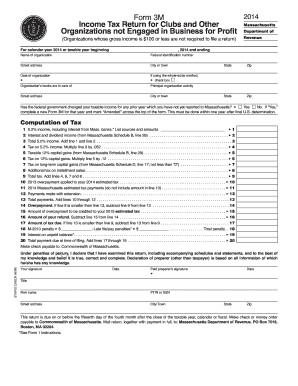

Get Ma Dor 3m 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MA DoR 3M online

How to fill out and sign MA DoR 3M online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Documenting your income and filing all the essential tax documents, including MA DoR 3M, is solely the duty of a US citizen.

US Legal Forms simplifies your tax handling, making it much clearer and accurate.

Store your MA DoR 3M securely. You should make sure that all your necessary documents and records are accurately placed while keeping in mind the deadlines and tax rules established by the Internal Revenue Service. Make it easy with US Legal Forms!

- Obtain MA DoR 3M in your web browser on any device.

- Access the interactive PDF file with a click.

- Begin filling out the online form field by field, guided by the sophisticated PDF editor's interface.

- Carefully enter text and figures.

- Click on the Date field to automatically set the current date or change it manually.

- Use the Signature Wizard to create your unique e-signature and sign within moments.

- Follow the IRS guidelines if you have any questions.

- Click on Done to save your changes.

- Continue to print the document, download it, or send it through Email, text, Fax, or USPS without leaving your web browser.

How to modify Get MA DoR 3M 2014: personalize forms digitally

Sign and distribute Get MA DoR 3M 2014 along with any additional corporate and personal documents online without squandering time and resources on printing and mailing. Maximize the benefits of our digital form editor featuring an integrated compliant eSignature tool.

Authorizing and submitting Get MA DoR 3M 2014 documents electronically is swifter and more efficient than handling them on paper. Nonetheless, it necessitates the use of online solutions that ensure a high level of data security and provide you with a certified resource for creating eSignatures. Our strong online editor is just what you need to prepare your Get MA DoR 3M 2014 and other personal and business or tax forms accurately and appropriately in accordance with all the regulations. It contains all the vital tools to effortlessly and promptly complete, modify, and endorse documents online and incorporate Signature fields for others, indicating who and where should sign.

It requires only a few straightforward steps to fill out and endorse Get MA DoR 3M 2014 digitally:

When signing Get MA DoR 3M 2014 with our comprehensive online editor, you can always be assured of its legal validity and court-admissibility. Prepare and submit documentation in the most efficient manner possible!

- Open the selected file for further editing.

- Utilize the top toolkit to add Text, Initials, Image, Check, and Cross indicators to your template.

- Highlight the essential information and redact or eliminate the sensitive ones if necessary.

- Click on the Sign tool above and choose how you prefer to eSign your document.

- Sketch your signature, type it, upload its image, or select another choice that suits you.

- Navigate to the Edit Fillable Fields panel and insert Signature areas for others.

- Click on Add Signer and enter your recipient’s email to assign this field to them.

- Confirm that all submitted data is complete and accurate before clicking Done.

- Distribute your files with others using one of the available methods.

Related links form

To contact the governor of Massachusetts, you can visit the official state website where you will find contact information including email addresses and phone numbers. Sending a message or calling directly is effective for sharing your thoughts or concerns. Engaging with state leadership is an important way to voice your opinions on issues affecting you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.