Loading

Get Ma Dor M-990t 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR M-990T online

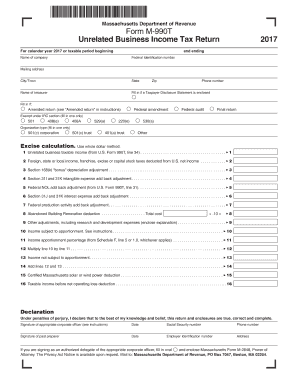

Filing the Massachusetts Department of Revenue Form M-990T online is essential for organizations engaged in unrelated business activities. This comprehensive guide will provide users with clear, step-by-step instructions to navigate the form effectively and ensure compliance.

Follow the steps to complete the MA DoR M-990T online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the name of your company in the designated field to identify your organization.

- Provide your federal identification number, ensuring it is accurate for tax reporting purposes.

- Fill out the mailing address, including city/town, state, and ZIP code, to ensure correct correspondence.

- Input your primary phone number for any necessary contact regarding your filing.

- Include the name of the treasurer overseeing financial matters within your organization.

- Indicate whether a Taxpayer Disclosure Statement accompanies your return by marking the appropriate option.

- Select relevant checkboxes for return types, such as 'Amended return' or 'Final return', according to your situation.

- Complete the excise calculation section by entering your unrelated business taxable income and any necessary adjustments.

- Review apportionment factors for income and provide the necessary calculations for Massachusetts-based apportionment.

- Finalize your form by signing in the appropriate field and entering the date of submission. Include any preparer's signatures where necessary.

- After reviewing all entries for accuracy, save any changes made to the document, download the completed form, print it for your records, or prepare to share it with the Department of Revenue.

Complete your MA DoR M-990T form online to ensure your organization remains compliant and avoid possible penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The long-term capital gains tax in Massachusetts is set at 5% for most gains, making it essential for residents to consider when planning their investments. Understanding these tax obligations is vital for effective financial management. Utilizing resources like uslegalforms can provide clarity on how the MA DoR M-990T fits into your overall tax strategy.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.