Get Me Mrs 706me 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

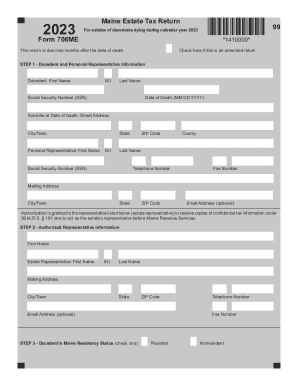

How to fill out and sign form 706me online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Nowadays, most Americans tend to prefer to do their own income taxes and, furthermore, to fill out papers in electronic format. The US Legal Forms web-based platform helps make the procedure of preparing the ME MRS 706ME fast and handy. Now it will take not more than thirty minutes, and you can do it from any place.

Tips on how to fill up ME MRS 706ME quick and simple:

-

Open up the PDF blank in the editor.

-

See the highlighted fillable lines. This is where to place your information.

-

Click the option to pick when you see the checkboxes.

-

Go to the Text icon along with other powerful features to manually edit the ME MRS 706ME.

-

Confirm every piece of information before you continue to sign.

-

Create your distinctive eSignature by using a key-board, camera, touchpad, computer mouse or cell phone.

-

Certify your web-template electronically and place the particular date.

-

Click on Done continue.

-

Download or deliver the record to the receiver.

Ensure that you have completed and delivered the ME MRS 706ME correctly in time. Look at any applicable term. If you provide false details with your fiscal papers, it can lead to significant fees and cause problems with your annual tax return. Be sure to use only expert templates with US Legal Forms!

Video instructions and help with filling out and completing 706 me

Use this video to understand how to complete the 706me fiu sample with minimal wasted effort. Spend time on watching instead of completing the sample again.

For 2018, the estate and gift tax exemption is $5.6 million per individual, up from $5.49 million in 2017. That means an individual can leave $5.6 million to heirs and pay no federal estate or gift tax. A married couple will be able to shield north of $11 million ($11.2 million) from federal estate and gift taxes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.