Get Ma Dor Tsa 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DoR TSA online

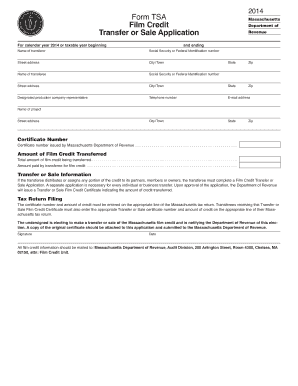

This guide provides a comprehensive overview of filling out the Massachusetts Department of Revenue Film Credit Transfer or Sale Application (MA DoR TSA) online. Whether you are new to this process or looking for a clear refresher, you will find step-by-step instructions to help you navigate each section of the form.

Follow the steps to complete your MA DoR TSA online.

- Click the ‘Get Form’ button to access and open the MA DoR TSA online in your preferred document editor.

- Enter the name of the transferor, along with their Social Security or Federal Identification number in the designated fields.

- Fill in the street address, city or town, state, and zip code for the transferor. Ensure accuracy to avoid any processing issues.

- Input the name of the transferee and their Social Security or Federal Identification number in the respective fields.

- Provide the street address, city or town, state, and zip code for the transferee as you have done for the transferor.

- Specify the name of the designated production company representative and include their contact information, such as telephone number and email address.

- Input the name of the project and the corresponding street address and zip code.

- Enter the certificate number as assigned by the Massachusetts Department of Revenue.

- Indicate the total amount of film credit being transferred in the designated box.

- Document the amount paid by the transferee for the film credit in the provided field.

- Sign and date the application to certify the information provided is accurate.

- Once all sections are completed, you can save your changes, download a copy for your records, print the form, or share it as needed.

Complete your application online today to ensure a smooth transfer of your film credits.

Get form

Related links form

In tax terminology, DoR stands for the Department of Revenue, which oversees tax collection and compliance within the state. The MA DoR TSA plays a vital role in ensuring taxpayers meet their obligations and receive necessary guidance. Understanding what DoR means in tax is important for effective financial planning. For personalized assistance, consider utilizing platforms like uslegalforms that cater to your tax documentation needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.