Loading

Get Ma M-8736 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA M-8736 online

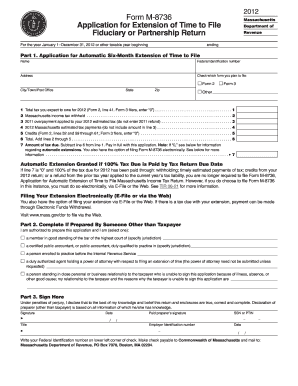

Filling out the MA M-8736 form online is an essential step for fiduciaries and partnerships seeking an extension of time to file their Massachusetts income tax returns. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the MA M-8736 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field and your federal identification number. This information is crucial for proper identification.

- Fill in your address, including city, town, or post office, along with your state and zip code. Ensure these details are accurate to avoid any processing issues.

- In the section that asks you to check which form you plan to file, mark the appropriate box corresponding to whether you will use Form 2, Form 3, or some other form. This is vital for directing your extension request.

- Complete the field for the total tax you expect to owe for the specified tax year, including any necessary calculations from the corresponding lines of Form 2 or Form 3.

- Enter the Massachusetts income tax withheld in the designated line. This amount should reflect your withholding for the year.

- Input the amount of overpayment applied from your previous year’s tax return. Ensure you do not include any refund when completing this section.

- List your 2012 Massachusetts estimated tax payments. Do not include the amount entered in the previous line.

- Fill in any applicable credits, ensuring to follow the instructions laid out for Form 2 or Form 3 filers.

- Calculate the total, which is the sum of the lines from the tax withheld, overpayment applied, estimated tax payments, and credits. Ensure this total is accurate.

- Determine the amount of tax due by subtracting the total calculated in the previous step from the total expected tax owed. If this amount is zero, note the automatic extension details provided.

- At this point, you should review all the entered information to confirm accuracy. Once you are satisfied that everything is correct, save your changes.

- Finally, you may choose to download, print, or share the completed form as necessary once all details have been filled in and verified.

Complete your MA M-8736 form online today to ensure your extension is filed correctly and on time.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

As of now, tax refunds may take several weeks due to processing variances and increased filing volumes. It’s wise to check your refund status through the Massachusetts Department of Revenue for the latest updates on your MA M-8736. Patience is key during peak times.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.