Loading

Get Md At3-51 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD AT3-51 online

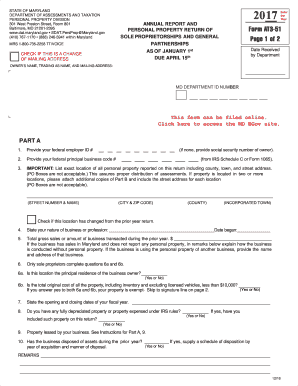

The MD AT3-51 form is essential for sole proprietorships and general partnerships to report personal property in the state of Maryland. This guide offers clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to effectively complete the MD AT3-51 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the owner's name, trading as name, and mailing address in the designated fields. Ensure that the information is current and accurate.

- Input your federal employer identification number (EIN). If you do not have an EIN, provide your social security number.

- Provide your federal principal business code number in the specified field.

- List the exact location of all personal property reported, including the county, town, and street address. Remember, PO Boxes are not acceptable.

- State the nature of your business or profession and the date your business began.

- Fill in the total gross sales or amount of business transacted during the prior year in the appropriate section.

- For sole proprietors, complete questions 6a and 6b regarding the principal residence of the business owner and the total original cost of property.

- Indicate the opening and closing dates of your fiscal year in the provided space.

- Answer whether you have any fully depreciated property and if it has been included in the return.

- If applicable, report any property leased by your business and any assets disposed of during the prior year, along with the required additional information.

- Complete the second part of the form which includes reporting on furniture, fixtures, commercial inventory, and any manufacturing equipment.

- Finally, review all entries for accuracy before signing the form. Ensure that your signature, date, and contact information are clearly provided.

- Save your changes, and download or print the completed form to submit as required.

Begin filling out your MD AT3-51 form online to ensure timely submission and compliance.

Getting a Maryland EIN number involves filling out the EIN application on the IRS website. Be prepared to provide necessary business information. This simple step is key for any business looking to operate in Maryland under MD AT3-51 guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.