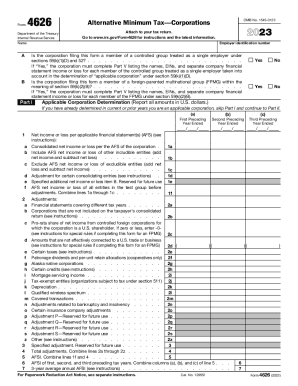

Get Irs 4626 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:When individuals aren?t connected to document management and law processes, filling out IRS documents can be quite nerve-racking. We comprehend the necessity of correctly finalizing documents. Our online software offers the utility to make the procedure of processing IRS forms as elementary as possible. Follow this guideline to quickly and accurately complete IRS 4626.

How you can submit the IRS 4626 on the Internet:

-

Click on the button Get Form to open it and start modifying.

-

Fill all necessary fields in the file making use of our advantageous PDF editor. Switch the Wizard Tool on to complete the process even easier.

-

Check the correctness of added details.

-

Add the date of completing IRS 4626. Utilize the Sign Tool to create a special signature for the file legalization.

-

Complete editing by clicking on Done.

-

Send this record directly to the IRS in the easiest way for you: via email, with digital fax or postal service.

-

You are able to print it on paper when a copy is required and download or save it to the preferred cloud storage.

Utilizing our online software can certainly make professional filling IRS 4626 possible. make everything for your comfortable and simple work.

AMT Overview. 1) Maximize Retirement Contributions. ... 2) FSA/HSA. ... 3) Switch from the Standard Deduction to Itemized. ... 4) Reduce your Taxable Investment Income. ... 5) Replace Private Activity Municipal Bonds. ... 6) Plan your stock options carefully. ... 7) Manage your miscellaneous itemized deductions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.