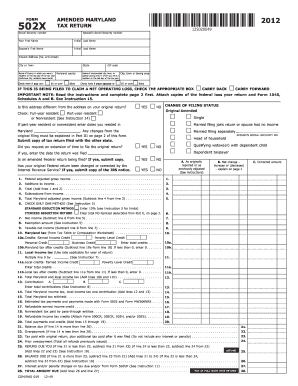

Get Md Comptroller 502x 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MD Comptroller 502X online

How to fill out and sign MD Comptroller 502X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Documenting your income and submitting all the essential tax documents, including MD Comptroller 502X, is the exclusive duty of a US citizen. US Legal Forms makes your tax management more accessible and accurate.

You can locate any legal templates you require and complete them digitally.

Keep your MD Comptroller 502X safe. Ensure that all your accurate documents and information are in the correct place while keeping in mind the deadlines and tax regulations established by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Obtain MD Comptroller 502X directly through your web browser on your device.

- Access the fillable PDF file with a click.

- Start completing the template section by section, adhering to the prompts of the advanced PDF editor’s interface.

- Carefully input text and numbers.

- Select the Date field to automatically set the current date or modify it manually.

- Utilize the Signature Wizard to produce your personalized e-signature and authenticate in moments.

- Refer to the IRS guidelines if you have further inquiries.

- Hit Done to preserve your modifications.

- Proceed to print the document, save it, or send it via Email, SMS, Fax, or USPS without leaving your web browser.

How to Modify Get MD Comptroller 502X 2012: Personalize Forms Online

Forget the conventional paper-driven method of executing Get MD Comptroller 502X 2012. Get the form completed and validated quickly with our expert online editor.

Are you compelled to alter and finalize Get MD Comptroller 502X 2012? With a powerful editor like ours, you can accomplish this in just a few minutes without needing to print and rescan documents repeatedly. We offer entirely modifiable and user-friendly form templates that will serve as a foundation to assist you in completing the necessary form online.

All documents automatically feature fillable fields you can utilize once you access the form. However, if you need to enhance the existing content or add new information, you can select from a variety of editing and annotation features. Emphasize, censor, and add remarks to the text; insert checkmarks, lines, text boxes, images, notes, and comments. Furthermore, you can promptly certify the document with a legally-recognized signature. The finished document can be shared with others, saved, imported to external applications, or converted to various formats.

You’ll never go wrong by selecting our online solution to process Get MD Comptroller 502X 2012 because it's:

Don’t waste time adjusting your Get MD Comptroller 502X 2012 the traditional way - with pen and paper. Utilize our comprehensive solution instead. It offers an extensive array of editing capabilities, built-in eSignature features, and convenience. What distinguishes it is the collaborative options - you can work on forms with anyone, establish a well-structured document approval process from scratch, and much more. Try our online tool and maximize your value!

- Simple to set up and use, even for individuals who haven’t filled out forms online previously.

- Robust enough to accommodate diverse editing requirements and types of documents.

- Reliable and secure, ensuring your editing experience is protected every time.

- Accessible across multiple operating systems, making it easy to complete the form from anywhere.

- Capable of generating forms from pre-designed templates.

- Compatible with a range of file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

To write a check to the Comptroller of Maryland, start with the date on the top right. Write 'Comptroller of Maryland' on the payee line and include your taxpayer identification information in the memo line. After signing the check, send it to the appropriate address listed on the Maryland tax website, which ensures proper handling of your payment.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.