Loading

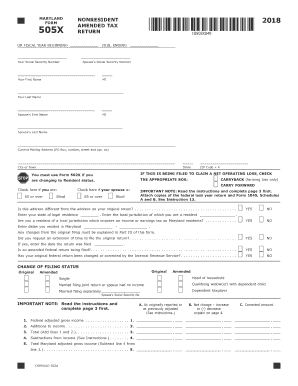

Get Md Comptroller 505x 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 505X online

The MD Comptroller 505X is an essential form for nonresidents who need to amend their Maryland tax return. This guide provides a step-by-step process to help you fill out the form correctly and efficiently online.

Follow the steps to complete your amended tax return.

- Locate the ‘Get Form’ button to access the MD Comptroller 505X online form and open it for editing.

- Enter your personal information, including your Social Security number, full name, and current mailing address. Ensure accuracy in this section as it is crucial for identification purposes.

- Indicate if you or your spouse are 65 or older or blind by checking the appropriate boxes. This information can affect your tax exemptions.

- Complete the section regarding your residency status and local jurisdiction. Input the dates you resided in Maryland during the tax year.

- If applicable, check the boxes concerning any previous extensions or changes regarding your federal tax return and explain adjustments in Part III.

- Fill in your federal adjusted gross income along with any additions or subtractions required. Follow the instructions closely to ensure all calculations are correct.

- Choose between the standard deduction method or itemized deduction method, and provide the necessary figures for each.

- Proceed to calculate your taxable net income and applicable tax credits, ensuring to enter accurate figures based on your initial return.

- Review all provided information for accuracy before finalizing the form. Attach any necessary supporting documents, such as federal forms or schedules.

- Once the form is complete, you can save your changes, download, print, or share the form as needed before submission.

Complete your MD Comptroller 505X online today for a seamless tax amendment experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can schedule an appointment with the Comptroller of Maryland through their official website or by calling their office. It is best to have all your documents ready for review during your appointment. If you need help preparing, consider using uslegalforms for expert guidance. An appointment will allow you to discuss any specific issues related to the MD Comptroller 505X.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.