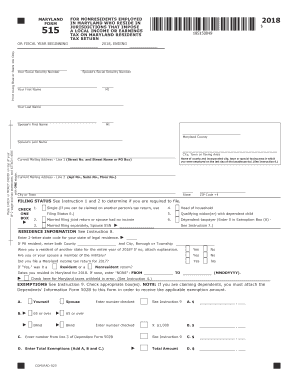

Get Md Comptroller 515 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MD Comptroller 515 online

How to fill out and sign MD Comptroller 515 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Recording your earnings and submitting all the essential tax documents, including MD Comptroller 515, is the exclusive responsibility of a US citizen.

US Legal Forms aids in making your tax preparation clearer and more accurate.

Keep your MD Comptroller 515 safe. Ensure that all your relevant documents and information are properly organized while considering the deadlines and tax regulations established by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Obtain MD Comptroller 515 on your device from the web.

- Access the fillable PDF file with a single click.

- Begin filling out the template step by step, following the prompts of the advanced PDF editor's interface.

- Carefully input text and numerical data.

- Click the Date field to automatically insert the current date or manually adjust it.

- Use the Signature Wizard to create your personal e-signature and sign in just minutes.

- Refer to IRS guidelines if you have any additional inquiries.

- Select Done to save the modifications.

- Proceed to print the document, download it, or send it via E-mail, SMS, Fax, or USPS without exiting your browser.

How to Update Get MD Comptroller 515 2018: Personalize Forms Online

Your swiftly adjustable and customizable Get MD Comptroller 515 2018 template is easily accessible. Maximize our collection featuring an integrated online editor.

Do you delay crafting Get MD Comptroller 515 2018 because you feel uncertain about where to begin and how to proceed? We recognize your concerns and offer an excellent remedy that doesn't involve combating your procrastination!

Our online library of ready-to-edit templates enables you to filter and choose from thousands of fillable documents tailored for various purposes and circumstances. However, obtaining the file is merely the beginning. We equip you with all the essential tools to complete, sign, and modify the form of your choice without leaving our site.

All you have to do is access the form in the editor. Review the wording of Get MD Comptroller 515 2018 and ensure it's what you are looking for. Begin altering the form by utilizing the annotation tools to provide your form with a more structured and polished appearance.

In summary, along with Get MD Comptroller 515 2018, you will receive:

With our professional option, your finalized documents are generally legally binding and fully encrypted. We ensure to protect your most sensitive information.

Acquire what is necessary to create a professionally appearing Get MD Comptroller 515 2018. Make a wise choice and explore our foundation now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and correct the existing text.

- If the form is also for others, you can incorporate fillable fields and share them for others to complete.

- Once you're finished editing the template, you can download the file in any available format or choose any sharing or delivery options.

- A comprehensive suite of editing and annotation tools.

- An integrated legally binding eSignature solution.

- The capability to create documents from scratch or based on the pre-uploaded template.

- Compatibility with different platforms and devices for enhanced convenience.

- Multiple options for securing your files.

- A wide array of delivery options for easier sharing and sending out documents.

- Adherence to eSignature regulations governing the use of eSignature in electronic transactions.

Filling out an Employee withholding Exemption Certificate requires you to enter your personal information and select the exemption type you are claiming. Be meticulous about checking against the MD Comptroller 515 guidelines to ensure you meet the requirements for exemption. For personalized assistance, consider visiting uslegalforms, which can provide you with templates that simplify the form-filling process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.