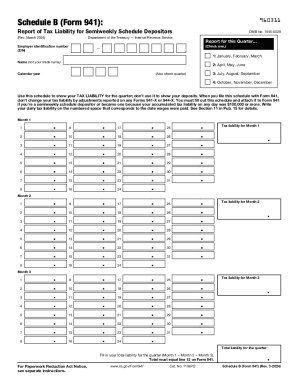

Get Irs 941 - Schedule B 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign 941 sch b online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:When you aren?t associated with document managing and legal procedures, filling in IRS documents will be extremely exhausting. We understand the significance of correctly finalizing documents. Our online software offers the utility to make the mechanism of completing IRS docs as simple as possible. Follow these tips to properly and quickly fill out IRS 941 - Schedule B.

The way to complete the IRS 941 - Schedule B on-line:

-

Click the button Get Form to open it and start modifying.

-

Fill all required lines in your document making use of our professional PDF editor. Switch the Wizard Tool on to finish the procedure even easier.

-

Ensure the correctness of filled info.

-

Include the date of submitting IRS 941 - Schedule B. Utilize the Sign Tool to make an exclusive signature for the document legalization.

-

Finish editing by clicking on Done.

-

Send this document to the IRS in the most convenient way for you: via e-mail, with digital fax or postal service.

-

It is possible to print it out on paper when a copy is needed and download or save it to the favored cloud storage.

Using our online software can certainly make skilled filling IRS 941 - Schedule B possible. We will make everything for your comfortable and simple work.

Form 941, which is the Employer's Quarterly Federal Tax Return, can be filed electronically to the IRS. ... A payroll service provider that is approved for e-filing and an authorized IRS Authorized Signatory are the two options available to businesses to e-file form 941.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.