Loading

Get Md Sdat 1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD SDAT 1 online

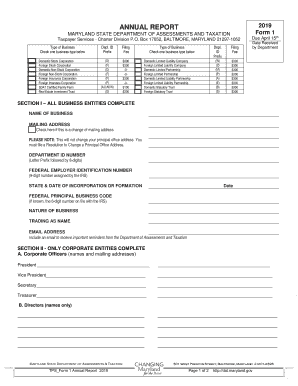

The MD SDAT 1 form is an essential document for businesses in Maryland to report annually to the State Department of Assessments and Taxation. This guide will help you navigate the online process of completing this form, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete the MD SDAT 1 online.

- Click the ‘Get Form’ button to access the MD SDAT 1 online and open it in the document editor.

- Select the appropriate type of business from the options provided. This includes Domestic Stock Corporation, Foreign Stock Corporation, and other categories. Ensure that you check the box next to the correct type.

- Enter your Department ID number, which consists of a letter prefix followed by eight digits, in the designated field.

- Fill in the Federal Employer Identification Number, which is a 9-digit number assigned by the IRS. This is crucial for tax purposes.

- Provide the date of incorporation or formation of your business, along with the corresponding state.

- If known, input your Federal Principal Business Code, which is a 6-digit number assigned by the IRS for classification.

- Describe the nature of your business clearly and concisely.

- If applicable, include a trading name that your business operates under.

- Add an email address where you would like to receive important reminders from the Department of Assessments and Taxation.

- For corporate entities, list the names and mailing addresses of corporate officers under Section II.

- In Section III, answer the questions regarding ownership or leasing of personal property, licensing requirements, and gross sales in Maryland.

- Complete Section IV by signing and dating the form, ensuring that the proper individual signs it to avoid rejection.

- Once all sections are completed, save any changes made, and explore options to download, print, or share the form as needed.

Begin completing the MD SDAT 1 online now for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Not completing your annual report can lead to significant repercussions, including fines and potential dissolution of your business. The MD SDAT closely monitors compliance, and neglecting this requirement may jeopardize your business operations. Therefore, it is essential to stay on top of your annual reporting obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.