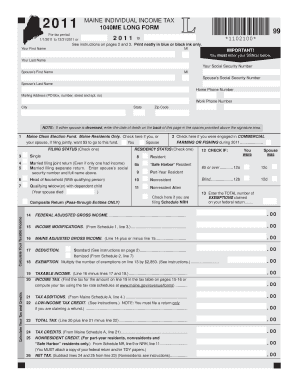

Get Me 1040me 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign ME 1040ME online

How to fill out and sign ME 1040ME online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans prefer to handle their own tax filings and, furthermore, to finalize reports electronically.

The US Legal Forms web service streamlines the process of submitting the ME 1040ME quickly and effortlessly.

Ensure that you have accurately completed and submitted the ME 1040ME before the deadline. Pay attention to any impending deadlines. Providing inaccurate information on your financial documents can result in substantial penalties and cause issues with your yearly tax return. Utilize only authorized templates with US Legal Forms!

- Open the PDF template in the editor.

- Refer to the designated fillable areas where you can enter your information.

- Select the checkboxes by clicking on the appropriate option.

- Explore the Text icon and other advanced features to manually edit the ME 1040ME.

- Review every detail closely before proceeding to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your document online and specify the exact date.

- Click Done to proceed.

- Save or dispatch the document to the recipient.

How to modify Get ME 1040ME 2011: personalize forms online

Experience the convenience of the feature-rich online editor while finalizing your Get ME 1040ME 2011. Utilize a variety of tools to swiftly complete the blanks and provide the necessary information promptly.

Creating documentation can be labor-intensive and costly unless you have pre-made fillable forms that you can complete digitally. The easiest way to handle the Get ME 1040ME 2011 is to utilize our expert and versatile online editing solutions. We equip you with all the essential tools for quick form completion and permit you to make any modifications to your forms, tailoring them to any requirements. Additionally, you can annotate the amendments and leave notes for others involved.

Here’s what you can achieve with your Get ME 1040ME 2011 in our editor:

Managing your Get ME 1040ME 2011 in our robust online editor is the quickest and most effective approach to organize, submit, and share your paperwork as needed from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All forms you create or fill out are safely stored in the cloud, ensuring you can always retrieve them whenever required without the risk of losing them. Stop spending time on manual document completion and eliminate physical papers; accomplish everything online with minimal effort.

- Fill in the empty fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize important information with a preferred color or underline them.

- Conceal sensitive information with the Blackout tool or simply remove it.

- Incorporate images to illustrate your Get ME 1040ME 2011.

- Replace the original text with one that suits your requirements.

- Add comments or sticky notes to inform others about the modifications.

- Insert additional fillable sections and assign them to specific individuals.

- Secure the document with watermarks, date stamps, and Bates numbering.

- Distribute the document in various formats and save it on your device or cloud after editing.

Maine source income includes any earnings tied to the economic activity occurring within the state. This can be wages from jobs based in Maine, rental income from Maine properties, or business income generated within its borders. Accurately identifying Maine source income on your ME 1040ME is essential to fulfill your tax obligations and can impact your financial planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.