Loading

Get Ak 6000i 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK 6000i online

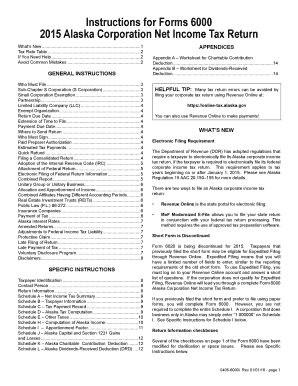

The AK 6000i is an essential document for filing the Alaska Corporation Net Income Tax Return. This guide provides a structured approach to help users understand and complete the form with confidence and accuracy.

Follow the steps to successfully complete the AK 6000i form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the taxpayer identification information, including the name of the corporation and its federal Employer Identification Number (EIN). Make sure to use the correct name as it appears on previous returns.

- Provide contact information for a designated contact person, including their name, email address, and phone number. This individual should be authorized to answer any questions about the tax return.

- Complete the 'Return Information' section by checking all applicable boxes, including whether the return is final, consolidated, or amended.

- Fill out Schedule A - Net Income Tax Summary with the relevant income details and any applicable deductions such as Alaska net operating loss deductions.

- Proceed to Schedule B - Taxpayer Information. If filing a consolidated return, list all corporations included in the return, along with their relevant details.

- Complete Schedule C - Tax Payment Record, entering the dates and amounts for any estimated tax payments made during the tax year.

- Move on to Schedule D - Alaska Tax Computation to calculate the tax based on reported income and applicable rates.

- Complete Schedule E - Other Taxes if applicable, detailing any other taxes owed in addition to the primary income tax.

- Fill out Schedule H - Computation of Alaska Income by inputting the federal taxable income and making necessary adjustments.

- For corporations with business activity outside Alaska, complete Schedule I - Apportionment Factor by calculating the company's property, payroll, and sales factors.

- If applicable, provide details in Schedule J - Alaska Capital and Section 1231 Gains and Losses to report any relevant gains and losses.

- Complete Schedule K - Alaska Charitable Contribution Deduction, reporting any charitable contributions and their limitations.

- After filling all relevant sections, review the form for accuracy and ensure all necessary schedules are attached.

- Finally, save changes, then download, print, or share the form as needed. Ensure it is sent to the appropriate Alaska Department of Revenue address.

Start filling out your AK 6000i online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can order Kansas tax forms directly from the Kansas Department of Revenue website. Many residents find that you can request forms online or by phone. Additionally, consider AK 6000i for an organized method to obtain and manage all your tax documents. It's a reliable way to handle your tax needs with ease.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.