Loading

Get Me Mrs 706me 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ME MRS 706ME online

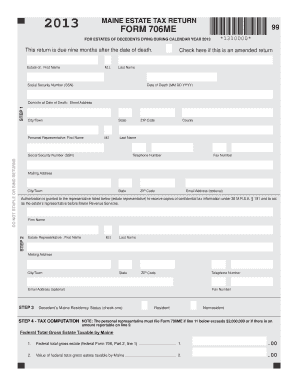

The ME MRS 706ME form is essential for reporting the estate tax for decedents who passed away in 2013. This guide provides step-by-step instructions on how to successfully complete the form online, ensuring that all necessary information is accurately submitted.

Follow the steps to efficiently complete the ME MRS 706ME form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin by entering the decedent's information, including their first name, middle initial, last name, Social Security number, and date of death in the designated fields.

- Fill in the domicile information at the time of death, including street address, city or town, and state.

- Provide the details of the personal representative responsible for the estate, including their first name, middle initial, last name, Social Security number, telephone number, fax number, mailing address, city or town, state, ZIP code, and an optional email address.

- If necessary, authorize another estate representative to receive confidential tax information by providing their firm name and contact details.

- Indicate the decedent’s residency status by checking the appropriate box for resident or nonresident.

- Complete the tax computation section, ensuring to accurately fill in figures from federal Form 706 where instructed, specifically lines that impact the federal total gross estate and gifts taxable by Maine.

- Enter the values corresponding to the various categories and ensure that the Maine taxable estate is calculated correctly, reflecting any deductions and adjustments as required.

- Finalize the calculation of the Maine estate tax, referring to the appropriate tax table for the rates applicable to the estate value.

- Declare the amount due or refund by completing lines related to payments made and any associated interest or penalties.

- Sign the form as the personal representative, including the date and other preparer information if applicable.

- Review the completed form for accuracy before saving changes, downloading, printing, or sharing it as required.

Start filling out the ME MRS 706ME online now to ensure timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

At the federal level, you can inherit up to $12.92 million in 2023 without incurring estate taxes. This limit allows for substantial value transfer without tax implications, benefiting large estates significantly. Understanding the context of ME MRS 706ME can provide additional insights into state and federal tax interactions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.