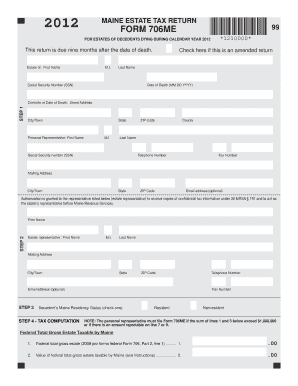

Get Me Mrs 706me 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign ME MRS 706ME online

How to fill out and sign ME MRS 706ME online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, the majority of Americans choose to manage their own income taxation and additionally prefer to complete forms electronically.

The US Legal Forms online platform simplifies and streamlines the submission of the ME MRS 706ME.

Ensure that you have accurately filled out and dispatched the ME MRS 706ME on time. Be mindful of any deadlines. Providing incorrect information on your tax reports can incur hefty penalties and complicate your annual tax return. Make sure to utilize only professional templates offered by US Legal Forms!

- Access the PDF example in the editor.

- Notice the marked fillable areas. This is where you enter your details.

- Select the option if you find the checkboxes.

- Move on to the Text tool and other advanced functions to manually modify the ME MRS 706ME.

- Review all the information before proceeding to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Validate your PDF form electronically and input the specific date.

- Click Done to continue.

- Download or forward the document to the recipient.

How to amend Get ME MRS 706ME 2012: personalize forms online

Your easily modifiable and adaptable Get ME MRS 706ME 2012 template is at your fingertips. Utilize our assortment with an integrated online editor.

Do you delay finishing Get ME MRS 706ME 2012 because you simply don’t know how to begin and how to progress? We comprehend your predicament and have a remarkable solution for you that has nothing to do with combating your procrastination!

Our online repository of ready-to-use templates enables you to filter through and select from countless fillable forms suited for different objectives and situations. However, acquiring the file is just the beginning. We provide you all the essential tools to complete, certify, and modify the template of your choosing without departing our website.

All you need to do is to open the template in the editor. Review the wording of Get ME MRS 706ME 2012 and confirm if it’s what you’re looking for. Begin completing the form by utilizing the annotation tools to give your document a more structured and polished appearance.

In summary, alongside Get ME MRS 706ME 2012, you will receive:

With our fully-equipped tool, your finished forms are typically legally binding and fully encrypted. We ensure the protection of your most sensitive information and data.

Get everything you need to create a professional-looking Get ME MRS 706ME 2012. Make the right decision and try our system today!

- Insert checkmarks, circles, arrows, and lines.

- Emphasize, redact, and correct the existing text.

- If the template is intended for others too, you can insert fillable fields and distribute them for others to fill out.

- Once you’re done with the template, you can download the file in any available format or select any sharing or delivery options.

- A comprehensive set of editing and annotation tools.

- A built-in legally-binding eSignature capability.

- The option to create forms from scratch or based on the pre-uploaded template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for safeguarding your documents.

- A variety of delivery methods for easier sharing and dispatching documents.

- Adherence to eSignature regulations governing the use of eSignature in online transactions.

Generally, states like New Jersey and Maryland are known for having some of the most burdensome estate tax structures in the country. Maine, with its ME MRS 706ME regulations, is relatively more favorable when compared to these states. Always consider consulting with estate planning experts to navigate the complexities of estate taxes efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.