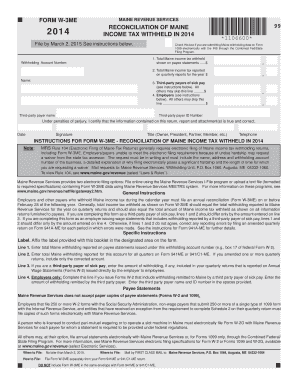

Get Me Mrs W-3me 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign ME MRS W-3ME online

How to fill out and sign ME MRS W-3ME online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans choose to handle their own tax filings and, moreover, to complete forms digitally.

The US Legal Forms online service simplifies the task of submitting the ME MRS W-3ME, making it convenient and straightforward.

Ensure that you have accurately filled out and submitted the ME MRS W-3ME on time. Be mindful of any deadlines. Providing incorrect information in your financial documents could lead to significant penalties and complications with your annual tax return. Rely solely on professional templates from US Legal Forms!

- Open the PDF document in the editor.

- Review the highlighted fields. This is where your information should be entered.

- Select the option you prefer when you notice the checkboxes.

- Explore the Text icon and other robust features to personalize the ME MRS W-3ME manually.

- Thoroughly examine each detail before proceeding to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Validate your document online and indicate the specific date.

- Click Done to proceed.

- Download or send the file to the intended recipient.

How to modify Get ME MRS W-3ME 2014: personalize forms online

Put the appropriate document management features at your disposal. Execute Get ME MRS W-3ME 2014 with our dependable tool that merges editing and eSignature capabilities.

If you wish to finalize and authenticate Get ME MRS W-3ME 2014 online without difficulty, then our online cloud-based solution is the perfect option. We offer a comprehensive template library of ready-to-use forms that you can adjust and fill out online. Furthermore, there's no need to print the form or employ external services to make it fillable. All the essential tools will be instantly accessible once you open the document in the editor.

Let’s explore our online editing features and their primary functions. The editor has an intuitive interface, so it won't take much time to learn how to use it. We’ll examine three key components that enable you to:

In addition to the features mentioned earlier, you can protect your document with a password, apply a watermark, convert the document to the desired format, and much more.

Our editor simplifies editing and certifying the Get ME MRS W-3ME 2014. It allows you to do nearly everything related to managing forms. Additionally, we always ensure that your document editing experience is secure and compliant with key regulatory standards. All these factors make using our solution even more satisfying.

Obtain Get ME MRS W-3ME 2014, implement the necessary modifications and updates, and download it in your preferred file format. Try it out today!

- Adjust and comment on the template

- The upper toolbar contains tools that assist you in highlighting and obscuring text, excluding images and graphics (lines, arrows, and checkmarks, etc.), sign, initial, date the form, and more.

- Organize your documents

- Utilize the toolbar on the left if you want to rearrange the form or/and eliminate pages.

- Prepare them for distribution

- If you wish to make the document fillable for others and share it, you can use the tools on the right to add various fillable fields, signature and date, text boxes, etc.

Related links form

Filling out a withholding exemption form requires you to indicate that you qualify for exemption from withholding due to meeting specific criteria. You will need to provide your personal information and sign the form to certify your exemption status. Utilizing the ME MRS W-3ME form can simplify this process and help ensure that you fulfill Maine's tax obligations appropriately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.