Loading

Get Me Rew-2 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ME REW-2 online

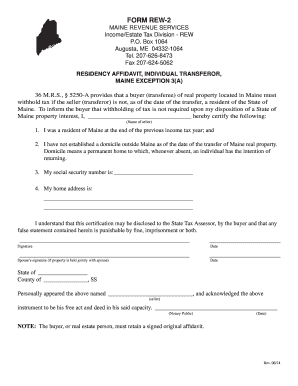

Filling out the ME REW-2 form is a crucial step for individuals transferring real property in Maine. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the ME REW-2 form online easily.

- Use the ‘Get Form’ button to access the ME REW-2 form. This action will allow you to view and fill out the document in a user-friendly digital format.

- Begin by entering your name as the seller in the designated space provided. Ensure that your name matches the documentation associated with the property.

- Confirm your residency status by checking the first statement, which states you were a resident of Maine at the end of the previous income tax year.

- Next, verify your domicile status by ensuring that you have not established residency outside of Maine as of the date of the property transfer.

- Enter your social security number in the provided field. Ensure that this number is accurate to avoid any issues with your submission.

- Fill in your home address in the designated areas. Make sure to include the complete address to ensure proper identification.

- Once all fields are completed, review the form for accuracy. Look for potential mistakes or omissions that may need correction.

- Sign and date the form to certify that the information provided is true. If the property is held jointly with a spouse, include their signature as well.

- If required, have the document notarized in the specified section, where a notary public will acknowledge your signature and the date of signing.

- Finally, save your changes, and you may choose to download, print, or share the completed form as per your needs.

Complete your ME REW-2 form online today for a seamless property transfer experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Maine, any resident or non-resident with taxable income must file a tax return. Additionally, if you receive certain types of income or meet specific thresholds, you may also be required to file. Leverage the ME REW-2 features on our platform to simplify the filing process and ensure you meet all requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.