Get Mi 4632 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 4632 online

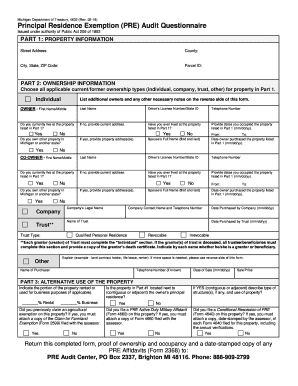

The MI 4632, or Principal Residence Exemption Audit Questionnaire, is a form used to verify the eligibility of an owner for the Principal Residence Exemption in Michigan. This guide provides clear and detailed instructions for completing the form online, ensuring users understand each component and requirement.

Follow the steps to successfully complete the MI 4632 online.

- Click ‘Get Form’ button to obtain the MI 4632 and open it in your preferred editor.

- In Part 1, enter the property information, including the street address, county, city, state, ZIP code, and parcel ID.

- In Part 2, select all applicable ownership types that apply to the property. This could include individual, company, trust, or other ownership types.

- For each owner listed, provide their first name, middle initial, last name, driver's license number or state ID, and telephone number.

- Answer the question regarding your current residency at the property listed in Part 1. If you do not currently reside there, provide your current address.

- Indicate whether you have previously lived at the property and provide the dates of your occupancy.

- If applicable, fill in the spouse's full name, the date you purchased the property, and similar details for co-owners.

- If the property is owned by a company or trust, complete the relevant sections, providing the legal name and contact details.

- In Part 3, indicate what portion of the property is rented or used for business purposes, if relevant.

- Answer the questions about any agricultural exemptions and the proximity of the property to your principal residence.

- After completing all sections, review your entries for accuracy, then save the changes.

- You may choose to download, print, or share the form as needed before submission.

Complete your MI 4632 form online today to ensure your Principal Residence Exemption is verified.

Get form

The amount saved through a homestead exemption in Michigan varies based on the property's assessed value and local tax rates. On average, homeowners can see a substantial reduction, sometimes exceeding thousands of dollars annually. To determine your specific savings, review your local tax documents and consider tools like MI 4632 available on uslegalforms to calculate potential benefits.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.