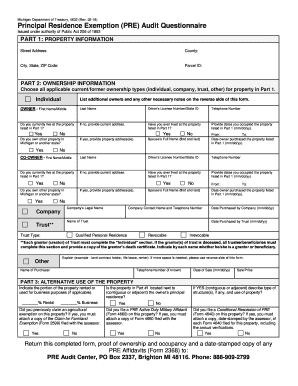

Get Mi 4632 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI 4632 online

How to fill out and sign MI 4632 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans prefer to complete their own tax returns and, additionally, to submit forms digitally.

The US Legal Forms online service streamlines the submission of the MI 4632, making it straightforward and free of complications. You can now finish it in no more than thirty minutes from anywhere.

Ensure you have accurately completed and submitted the MI 4632 on time. Consider any relevant deadlines. Providing incorrect information in your financial submissions may result in severe penalties and complications with your annual tax return. Make sure to utilize only official templates with US Legal Forms!

- Examine the PDF template in the editor.

- Look at the highlighted fillable sections. This is where you should input your information.

- Select the option if you come across checkboxes.

- Utilize the Text tool and other advanced features to modify the MI 4632 manually.

- Verify all details before you proceed to sign.

- Create your unique eSignature using a keyboard, webcam, touchpad, mouse, or smartphone.

- Authenticate your PDF form electronically and indicate the specific date.

- Click on Done to proceed.

- Store or send the document to the intended recipient.

How to modify Get MI 4632 2017: personalize forms online

Locate the suitable Get MI 4632 2017 template and adjust it instantly. Enhance your documentation process with a clever document modification solution for online forms.

Your everyday operations with documents and forms can become more effective when you have everything you need in one location. For instance, you can search for, access, and modify Get MI 4632 2017 in just a single browser tab. If you're looking for a specific Get MI 4632 2017, it’s easy to locate it using the intelligent search engine and reach it immediately. You don’t need to download it or look for an external editor to alter it and input your details. All tools for efficient work are included in just one comprehensive solution.

This editing solution enables you to personalize, complete, and sign your Get MI 4632 2017 form right then and there. Once you find a suitable template, click on it to enter the modification mode. When the form is opened in the editor, you have all the essential tools at your fingertips. You can conveniently fill in the designated fields and remove them if necessary with a straightforward yet versatile toolbar. Apply all adjustments immediately, and sign the document without leaving the tab by simply clicking the signature area. Afterwards, you can send or print your document if required.

Make additional personalized changes with the available tools.

Uncover new possibilities in efficient and uncomplicated paperwork. Find the Get MI 4632 2017 you require in minutes and complete it within the same tab. Eliminate the chaos in your documentation for good with the assistance of online forms.

- Annotate your document using the Sticky note tool by placing a note anywhere within the paper.

- Include necessary graphical elements, if needed, with the Circle, Check, or Cross tools.

- Alter or insert text at any location in the document using Texts and Text box tools. Add content with the Initials or Date tool.

- Change the template text using the Highlight, Blackout, or Erase tools.

- Add custom graphical elements using the Arrow, Line, or Draw tools.

Related links form

The exemption amount in Michigan varies based on the assessed value of your home. Generally, homeowners can receive a substantial reduction in taxable value, often resulting in noticeable tax savings. Under MI 4632, the percentage can be significant, especially for low-income families and elderly residents. This program is designed to support residents in maintaining their homes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.