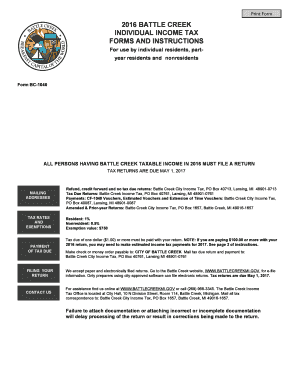

Get Mi Bc-1040 - Battle Creek 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI BC-1040 - Battle Creek online

How to fill out and sign MI BC-1040 - Battle Creek online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans prefer to handle their own income tax returns and additionally, to complete forms digitally.

The US Legal Forms online platform facilitates the process of filing the MI BC-1040 - Battle Creek swiftly and conveniently.

Ensure that you have accurately filled out and submitted the MI BC-1040 - Battle Creek by the deadline. Be mindful of any due dates. Providing incorrect information in your financial statements may lead to serious penalties and create issues with your yearly tax return. Utilize only legitimate templates from US Legal Forms!

- Access the PDF template in the editor.

- View the designated fillable sections. Here you can input your information.

- Select the option if you encounter the checkboxes.

- Navigate to the Text icon along with other advanced features to manually adjust the MI BC-1040 - Battle Creek.

- Review all the information prior to proceeding to sign.

- Create your personalized eSignature using a keypad, camera, touchpad, mouse, or smartphone.

- Authenticate your online template and enter the date.

- Click Done to proceed.

- Download or forward the document to the intended recipient.

How to modify Get MI BC-1040 - Battle Creek 2016: tailor forms online

Select a dependable document editing service you can trust. Modify, complete, and sign Get MI BC-1040 - Battle Creek 2016 securely online.

Frequently, altering documents, such as Get MI BC-1040 - Battle Creek 2016, can be difficult, particularly if you received them digitally but lack access to specialized software. Certainly, you can employ some alternative methods to circumvent this, but you risk producing a form that may not meet submission criteria. Utilizing a printer and scanner isn't a solution either since it consumes time and resources.

We provide a more seamless and effective approach to completing forms. A thorough assortment of document templates that are simple to customize and certify, to make fillable for others. Our platform offers more than just a collection of templates. One of the key advantages of utilizing our services is that you can modify Get MI BC-1040 - Battle Creek 2016 directly on our site.

As it is a web-based solution, it frees you from needing to download any software. Additionally, not all corporate policies permit you to install it on your work laptop. Here’s how you can easily and securely finalize your documentation with our platform.

Ditch paper and other ineffective methods for altering your Get MI BC-1040 - Battle Creek 2016 or other forms. Instead, leverage our tool that merges one of the largest libraries of ready-to-edit templates with powerful document editing services. It's straightforward and secure, potentially saving you a lot of time! Don’t just take our word for it, experience it for yourself!

- Click the Get Form > you’ll be promptly directed to our editor.

- Once opened, you can initiate the editing procedure.

- Select checkmark or circle, line, arrow, and cross along with other choices to comment on your form.

- Choose the date option to insert a specific date into your document.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to establish fillable {fields.

- Select Sign from the top toolbar to create and produce your legally-binding signature.

- Hit DONE and save, print, and share or download the resulting document.

Yes, you can file your Michigan tax return online, including the MI BC-1040 - Battle Creek form. Using online tax filing services simplifies the process, allows for faster processing, and often leads to quicker refunds. Ensure that the online platform you choose is trustworthy and guides you throughout the filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.