Get Mi Dot 163 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

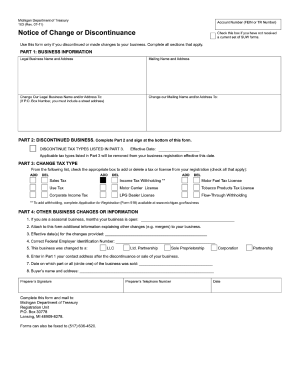

Tips on how to fill out, edit and sign MI DoT 163 online

How to fill out and sign MI DoT 163 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans seem to favor handling their own tax returns and, in addition, to complete documents digitally.

The US Legal Forms online platform simplifies the task of completing the MI DoT 163 quickly and conveniently.

Ensure that you have accurately completed and submitted the MI DoT 163 on time. Keep any deadlines in mind. Providing erroneous information in your tax documents may lead to significant penalties and result in complications with your annual tax return. Use only verified templates with US Legal Forms!

- Access the PDF template in the editor.

- Look at the highlighted fields. This is where you enter your information.

- Select the option if checkboxes are visible.

- Explore the Text tool and other advanced features to modify the MI DoT 163 manually.

- Double-check every detail before you proceed to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authorize your document electronically and input the specific date.

- Click Done to proceed.

- Store or forward the document to the recipient.

How to alter Get MI DoT 163 2011: tailor forms digitally

Choose a trustworthy document editing platform you can rely on. Amend, execute, and validate Get MI DoT 163 2011 safely online.

Frequently, dealing with documents, such as Get MI DoT 163 2011, can be a hassle, particularly if you obtained them in a digital format but lack access to specialized software. Naturally, you can employ some alternatives to navigate this, but you risk producing a file that fails to meet the submission standards. Utilizing a printer and scanner isn't a solution either due to its time- and resource-heavy nature.

We provide a more efficient and streamlined method for altering files. An extensive library of document templates that are easy to modify and certify, to create fillable for others. Our platform goes well beyond merely a collection of templates. One of the greatest advantages of using our service is that you can edit Get MI DoT 163 2011 directly on our site.

Bid farewell to paper and other ineffective methods for processing your Get MI DoT 163 2011 or other documents. Employ our tool instead that features one of the most extensive collections of ready-to-personalize templates and a powerful document editing tool. It's simple and secure, and can save you considerable time! Don’t just take our word for it, experience it yourself!

- Since it's a web-based solution, it spares you from needing to acquire any software application.

- Moreover, not all corporate policies permit you to install it on your work computer.

- Here’s the optimal way to seamlessly and securely carry out your documentation with our platform.

- Click the Get Form > you’ll be immediately redirected to our editor.

- Once launched, you can commence the editing procedure.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your document.

- Select the date field to input a specific date into your file.

- Include text boxes, images, and notes and more to enhance the content.

- Utilize the fillable fields option on the right to create fillable fields.

- Select Sign from the upper toolbar to generate and create your legally-binding signature.

- Press DONE and save, print, and share or obtain the document.

Related links form

Mail your Michigan form 5081 to the Michigan Department of Treasury at the designated address on the form's instructions. As with the MI DoT 163, ensure that all your information is accurate to facilitate timely processing. If you're unsure about the specifics, consider using services like uslegalforms to ensure your forms are completed correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.