Loading

Get Mi Dot 3683 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 3683 online

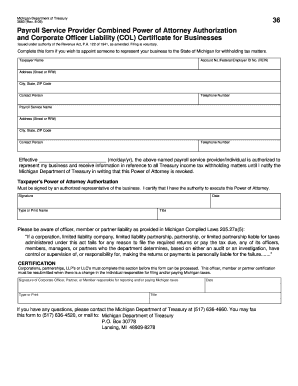

The MI DoT 3683 is an essential form for businesses in Michigan looking to appoint a payroll service provider for withholding tax matters. This guide provides step-by-step instructions to help you accurately complete the form online.

Follow the steps to fill out the MI DoT 3683 effectively.

- Press the ‘Get Form’ button to access the MI DoT 3683 form and open it in the editor.

- Begin by entering your business details in the 'Taxpayer Name' section, providing the formal name of your business.

- Next, input your 'Account No./Federal Employer ID No. (FEIN)' to ensure proper identification of your business.

- Fill in the 'Address' field with the legal address of your business, including street or RR#, city, state, and ZIP code.

- Designate a 'Contact Person' who will handle the communications related to this form, and include their telephone number.

- In the 'Payroll Service Name' section, provide the name of the payroll service provider you wish to authorize.

- Fill in the provider's address details just as you did for your business, including all necessary information.

- Designate a contact person for the payroll service and provide their telephone number.

- Specify the effective date of the authorization by filling in the 'Effective' date in the required format (mo/day/yr).

- The Taxpayer's Power of Attorney Authorization section must be signed by an authorized representative of the business; ensure you include the date of signature, your printed name, and your title.

- Lastly, in the certification section, that individual must sign once more, date the form, and indicate their title before submission.

- After completing all sections, you have the option to save changes, download, print, or share the form as required.

Complete the MI DoT 3683 online today to ensure your business complies with Michigan tax regulations.

To get a dot in Michigan, start by preparing the necessary documentation, such as your business identification and vehicle details. Next, you will complete the application for the MI DoT 3683, either online or in-person. Finally, submit the form along with any required fees to the Michigan Department of Transportation. If you encounter any challenges, uslegalforms offers valuable support to simplify the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.