Loading

Get Mi Dot 4567 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4567 online

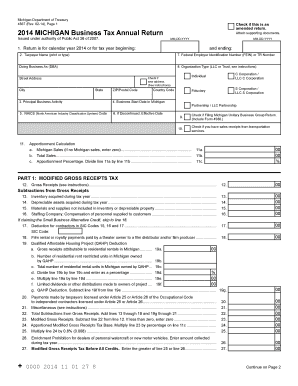

Filling out the MI DoT 4567, Michigan Business Tax Annual Return, online can streamline your filing process and ensure accuracy. This guide will walk you through each step and section of the form, making it easier for you to provide the necessary information.

Follow the steps to complete the MI DoT 4567 online

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter the calendar year for which you are filing, or the beginning and ending dates of your tax year, if not a calendar year.

- Input your taxpayer name clearly, ensuring to use either print or type. This also includes providing the Federal Employer Identification Number (FEIN) or TR number.

- Specify your organization type by selecting from the provided options like LLC or Trust as applicable.

- Fill in your principal business activity by providing a brief description of what your business does.

- Provide your business start date in Michigan to verify your operational timeline.

- Identify your North American Industry Classification System (NAICS) code. Refer to the applicable resources if needed.

- If applicable, enter the effective date of discontinuance, but ensure to file a Notice of Change if this applies.

- Complete the Apportionment Calculation using your amounts for Michigan sales and total sales as needed.

- Continue filling out each category in Parts 1, 2, 3, 4, and 5 as prompted on the form, ensuring to perform calculations accurately.

- After completing all entries, review your form for accuracy, save changes, and consider downloading, printing, or sharing as required.

Start filling out your MI DoT 4567 online today to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing an extension is not required, but it is recommended if you need more time to prepare your tax return. Using MI DoT 4567 can help you manage tax obligations comfortably, ensuring compliance without haste. Remember, having this extension can save you from filing complications later.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.