Loading

Get Mi Dot 4594 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4594 online

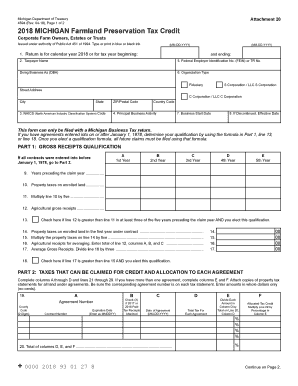

Filling out the MI DoT 4594 form online can seem daunting, but with this comprehensive guide, you will be able to navigate each section confidently. This form is essential for corporate farm owners, estates, or trusts applying for the Farmland Preservation Tax Credit in Michigan.

Follow the steps to complete the MI DoT 4594 online accurately.

- Click ‘Get Form’ button to access the MI DoT 4594 form online and open it in your editor.

- Begin by entering the tax year information. Specify if the return is for the calendar year or the tax year, entering the correct start and end dates in the format MM-DD-YYYY.

- Fill out the taxpayer name, Federal Employer Identification Number (FEIN) or Taxpayer Number (TR No.), and any 'Doing Business As (DBA)' name if applicable.

- Indicate the organization type by selecting the appropriate checkbox, such as fiduciary, S corporation, or C corporation.

- Provide your business address in the designated fields, including street, city, state, and ZIP/Postal code.

- Enter the North American Industry Classification System (NAICS) code that corresponds to your business activities.

- Complete the 'Principal Business Activity' field by providing a brief description of your business.

- If applicable, mention the business start date and, if your business has been discontinued, indicate the effective date.

- Proceed to Part 1 for gross receipts qualification and fill in the relevant years and property taxes as instructed. Ensure you follow the criteria provided for qualification.

- Continue onto Part 2, filling in taxes that can be claimed for credit and allocating those to each agreement. Ensure all information is accurate and corresponding agreement numbers are attached.

- Complete the subsequent sections as directed for taxes that cannot be claimed and for calculating your farmland preservation tax credit.

- Lastly, review all entered data for accuracy, then save your changes. You can download, print, or share the completed form as needed.

Complete your MI DoT 4594 form online today to ensure you receive your Farmland Preservation Tax Credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can file MI 1040 forms electronically or by mailing them to the designated address provided by the Michigan Department of Treasury. If you use a tax preparation platform, it often guides you on where to send your form. Always refer to the MI DoT 4594 for the latest filing instructions and address details.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.