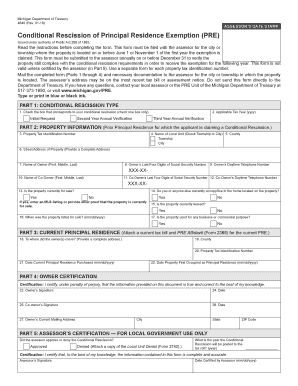

Get Mi Dot 4640 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MI DoT 4640 online

How to fill out and sign MI DoT 4640 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, the majority of Americans prefer to handle their own income tax returns and additionally, to fill out forms in digital format.

The US Legal Forms online platform simplifies the submission of the MI DoT 4640, making it straightforward and stress-free.

Ensure that you have accurately completed and submitted the MI DoT 4640 by the deadline. Be mindful of any time limits. Providing incorrect information on your financial documents could result in significant penalties and complications with your annual tax filing. Always use reliable templates from US Legal Forms!

- Access the PDF template in the editor.

- Observe the designated fillable fields. This is where you will input your information.

- Select the option by clicking on the checkboxes.

- Utilize the Text tool and other robust features to modify the MI DoT 4640 manually.

- Review every detail of your information before proceeding to sign.

- Create your personalized eSignature using a keypad, digital camera, touchpad, mouse, or smartphone.

- Certify your online document and indicate the specific date.

- Press Done to continue.

- Download or send the document to the intended recipient.

How to Modify Get MI DoT 4640 2015: Tailor Forms Online

Completing documentation is simpler with intelligent online solutions. Remove paperwork with easily accessible Get MI DoT 4640 2015 templates that you can modify online and print.

Creating documents and forms should be more attainable, whether it's a daily component of one's responsibilities or occasional tasks. When an individual must submit a Get MI DoT 4640 2015, reviewing guidelines and instructions on how to fill out a form correctly and what it should encompass can consume a significant amount of time and effort. Nonetheless, if you discover the appropriate Get MI DoT 4640 2015 template, finishing a document will no longer be a challenge with a smart editor available.

Uncover a wider array of features you can incorporate into your document workflow. There's no requirement to print, complete, and mark forms manually. With an advanced editing platform, all the crucial document processing features are perpetually within reach. If you aim to enhance your work process with Get MI DoT 4640 2015 forms, browse the template collection, select it, and discover a more straightforward approach to fill it out.

The more tools you are accustomed to, the easier it is to work with Get MI DoT 4640 2015. Experiment with the solution that provides everything needed to locate and modify forms in a single browser tab and eliminate manual paperwork.

- If you need to insert text in any part of the form or add a text field, utilize the Text and Text field tools and expand the text in the form as needed.

- Employ the Highlight tool to emphasize the key components of the form. If you need to hide or delete specific text sections, use the Blackout or Erase tools.

- Personalize the form by incorporating standard graphic elements into it. Utilize the Circle, Check, and Cross tools to add these elements to the forms when necessary.

- Should you require extra annotations, utilize the Sticky note feature and place as many notes on the forms page as needed.

- If the form requires your initials or date, the editor provides tools for that as well. Minimize the chance of errors using the Initials and Date tools.

- You can also insert custom graphic elements into the form. Use the Arrow, Line, and Draw tools to modify the file.

For most taxpayers, that'll be your return for the 2019 tax year which, by the way, will be due on April 15, 2020. The 2019 tax rates themselves are the same as the tax rates in effect for the 2018 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.