Loading

Get Mi Dot 4763 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4763 online

Filling out the MI DoT 4763 can seem complex, but with clear guidance, you can complete it accurately and efficiently. This guide aims to walk you through each section of the form, ensuring a smooth online submission process.

Follow the steps to successfully complete the MI DoT 4763.

- Press the ‘Get Form’ button to access the MI DoT 4763 form and open it for editing.

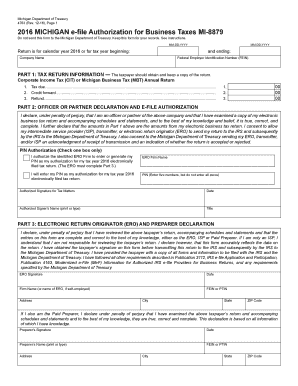

- Enter the tax return information in Part 1, including the tax type (Corporate Income Tax or Michigan Business Tax) and the amounts for tax due, credit forward, and refund. Make sure to input numbers clearly in the designated fields, using zeros if applicable.

- In Part 2, the officer or partner must declare their position within the company and verify that the electronic tax return is accurate. They should check the appropriate box to authorize either an ERO Firm to generate their Personal Identification Number (PIN) or enter their own PIN.

- Complete the authorized signature, date, name, and title fields. This step is crucial as it signifies the consent for the ERO to transmit the return. Ensure that all information is entered correctly.

- In Part 3, if applicable, the ERO or paid preparer should declare their review of the tax return. They must include their signature, the date, and the firm name, along with FEIN or PTIN.

- Verify that all parts of the form are filled out accurately and completely before finalizing. Users should retain a copy of the completed MI DoT 4763 for their records and ensure not to send it to the Michigan Department of Treasury unless specifically requested.

- Once all fields are completed and verified, users can save changes, download, print, or share the completed form as needed.

Take the next step in your document management by completing your MI DoT 4763 online today.

The common abbreviation for Michigan Department of Transportation is MDOT. This abbreviation is widely used in various documents and discussions regarding transportation policies and projects. If you are dealing with related paperwork or processes, such as those involving the MI DoT 4763, recognizing this abbreviation can simplify your communications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.