Get Mi Lcc-3890 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI LCC-3890 online

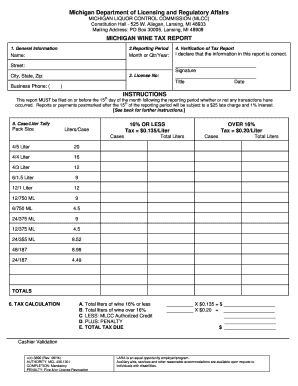

Filling out the MI LCC-3890, the Michigan wine tax report, is essential for wineries and out-of-state sellers of wine operating in Michigan. This guide will provide you with step-by-step instructions to ensure you complete the form accurately and submit it on time.

Follow the steps to complete the MI LCC-3890 successfully.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred digital document editor.

- In Box 1, enter the licensee name, business address, and business phone number.

- In Box 2, specify the reporting period by indicating the month and year for the tax report.

- In Box 3, fill in your license number as assigned by the Michigan Liquor Control Commission.

- In Box 4, sign the report, provide your title, and enter the date you are completing the form.

- In Box 5, identify the appropriate pack size from the table and enter the total cases shipped in the 'Cases' column. Use blank boxes for any pack sizes not listed. Multiply the number of cases by the corresponding liters per case to get the total liters.

- In Box 6, proceed as follows: A) Sum the total liters of wine at 16% or less and enter the amount on Line A. Multiply this by the tax rate of $0.135 and record the result. B) Sum the total liters over 16% and enter on Line B. Multiply by the tax rate of $0.20 and note this amount. C) Enter any authorized credits on Line C. D) Add any penalties owed on Line D. E) Subtract Line C from the sum of Lines A and B, add Line D to this total, and enter the final 'Total Tax Due' on Line E.

- Once all fields are completed and verified for accuracy, save your changes, and prepare to download, print, or share the report as needed for submission.

Ensure compliance and complete your tax reporting using the MI LCC-3890 online today!

Get form

To open a winery in Michigan, you first need to research and comply with the MI LCC-3890 guidelines. This involves securing the necessary licenses, crafting a business strategy, and choosing a suitable location. You should also assess your target market and plan your marketing approach. Platforms like uslegalforms can assist you in organizing the legal requirements to help launch your winery successfully.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.