Loading

Get Mi Tt262 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI TT262 online

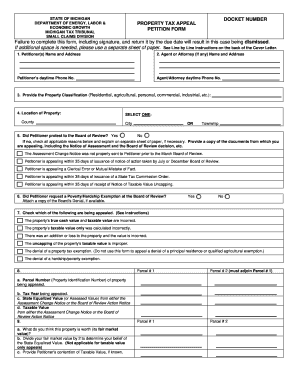

The MI TT262 form is a property tax appeal petition that allows individuals to contest property tax assessments in Michigan. This guide will walk you through each section of the form, providing clear instructions to help you complete it accurately and submit it on time.

Follow the steps to fill out the MI TT262 form with ease.

- Click the 'Get Form' button to access the MI TT262 online. This will open the form in a user-friendly digital editor.

- Enter the petitioner(s) name and address in the designated fields at the top of the form. Ensure accuracy as this information is crucial for processing your appeal.

- If you have an agent or attorney, provide their name and address in the relevant section. Include your daytime phone number and the agent or attorney's daytime phone number for any communication related to your case.

- Specify the property classification from options such as residential, agricultural, personal, commercial, or industrial. This classification is essential for determining the correct tax implications.

- Indicate the location of the property, selecting the county, city, and township where the property is situated.

- Respond to whether you protested to the Board of Review. If not, check applicable reasons for your appeal and attach any necessary documentation to support your claim.

- Answer the question regarding whether you requested a Poverty/Hardship Exemption, attaching a copy of the Board’s Denial if available.

- Check all relevant issues being appealed, including incorrect property value calculations or denials of tax exemptions, as instructed in the form.

- Provide the parcel numbers for properties being appealed, along with the tax year, state equalized value, and taxable value from official notices.

- State your belief about the property's fair market value and provide any known contention of taxable value.

- Explain the reason for your appeal in detail to justify your claim.

- Determine if the property qualifies for a principal residence exemption and calculate any applicable fees based on the provided fee schedule.

- Sign the form, either as the petitioner directly or through an authorized agent or attorney. Ensure that both the original and one copy of the completed form is submitted along with any attachments.

- Finally, save your changes, download the completed form, print it if needed, and share it as required.

Complete your MI TT262 form online today to ensure your property tax appeal is filed correctly and on time.

Related links form

You have to file a Michigan non-resident tax return if you earn income from Michigan sources. This includes wages, business income, and other taxable earnings generated within the state. If your income lies solely outside Michigan, you typically do not need to file. To navigate your requirements better, consider consulting the MI TT262.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.