Get Mn Dor M1pr 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M1PR online

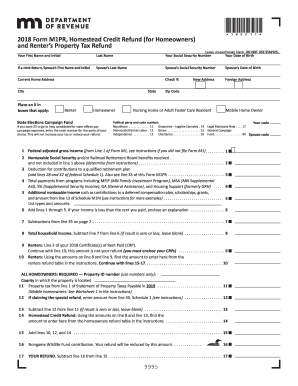

Filling out the MN DoR M1PR form online is a straightforward process that can significantly assist homeowners and renters in claiming their property tax refunds. This guide will walk you through each step of the form, ensuring you provide the necessary information accurately.

Follow the steps to complete the MN DoR M1PR form online.

- Click 'Get Form' button to obtain the MN DoR M1PR form and open it in your chosen online editor.

- Begin by filling in your first name and initial, followed by your last name. Ensure that this information matches your official documents.

- Enter your Social Security number and date of birth in the designated fields. If you are filing jointly, complete the spouse's first name, last name, Social Security number, and date of birth as well.

- Provide your current home address, marking if it is a foreign address, and check the boxes that apply to you, indicating if you are a renter or homeowner, and any other relevant options.

- If you wish to contribute $5 to a political party, enter the code from the list provided. This is optional and does not affect your refund amount.

- Input your federal adjusted gross income as noted from your Form M1. Follow any necessary instructions for adjustments or clarifications.

- List any nontaxable Social Security benefits received that should not be included in your adjusted gross income. Make sure to consult the instructions for further details.

- Complete information regarding any deductions for contributions to a qualified retirement plan.

- Aggregate all the relevant income and deductions. Fill in the total amounts accurately, using the provided lines for calculations.

- For homeowners, provide the Property ID number and complete the property tax information as outlined in the form. If claiming a special refund, complete the necessary calculations and inputs as instructed in the document.

- Once all information has been filled out, review the form for accuracy. Save any changes made to the file.

- Finally, you can either download, print, or share the completed MN DoR M1PR form as needed.

Complete your MN DoR M1PR form online today to ensure you receive the property tax benefits you are entitled to.

Get form

Processing a MN state tax return usually takes about 4 to 6 weeks. However, this timeline may extend depending on whether you filed electronically or submitted a paper return. Keeping your records organized can help expedite the process. If you seek clarity on your filing, the US Legal Forms platform offers resources to guide you through your MN DoR M1PR requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.