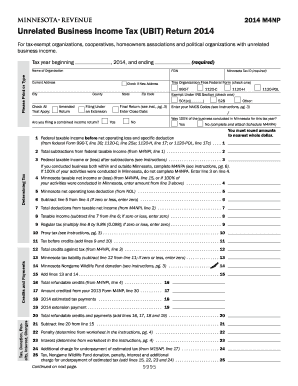

Get Mn Dor M4np 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign UBIT online

How to fill out and sign 2014 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, most Americans prefer to do their own income taxes and, in fact, to fill in reports digitally. The US Legal Forms browser platform makes the process of e-filing the MN DoR M4NP simple and convenient. Now it requires no more than 30 minutes, and you can accomplish it from any location.

The best way to file MN DoR M4NP fast and easy:

-

Open up the PDF blank in the editor.

-

See the outlined fillable lines. This is where to put in your information.

-

Click on the option to pick if you see the checkboxes.

-

Proceed to the Text tool along with other powerful functions to manually modify the MN DoR M4NP.

-

Verify all the details before you keep signing.

-

Create your unique eSignature by using a keyboard, digital camera, touchpad, computer mouse or mobile phone.

-

Certify your template online and place the date.

-

Click on Done continue.

-

Save or send out the record to the recipient.

Make sure that you have filled in and directed the MN DoR M4NP correctly by the due date. Take into account any applicable term. When you provide false info with your fiscal reports, it can lead to significant charges and cause problems with your yearly income tax return. Be sure to use only professional templates with US Legal Forms!

How to edit Preparer: customize forms online

Go with a reliable file editing option you can trust. Modify, execute, and sign Preparer securely online.

Too often, working with forms, like Preparer, can be a challenge, especially if you received them online or via email but don’t have access to specialized tools. Of course, you can use some workarounds to get around it, but you can end up getting a document that won't meet the submission requirements. Using a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We provide an easier and more efficient way of modifying files. A rich catalog of document templates that are straightforward to edit and certify, and then make fillable for others. Our solution extends way beyond a set of templates. One of the best parts of utilizing our services is that you can revise Preparer directly on our website.

Since it's a web-based option, it saves you from having to get any computer software. Additionally, not all corporate rules allow you to install it on your corporate laptop. Here's how you can effortlessly and securely execute your paperwork with our platform.

- Click the Get Form > you’ll be instantly taken to our editor.

- Once opened, you can kick off the editing process.

- Choose checkmark or circle, line, arrow and cross and other choices to annotate your document.

- Pick the date option to include a specific date to your document.

- Add text boxes, graphics and notes and more to complement the content.

- Utilize the fillable fields option on the right to create fillable {fields.

- Choose Sign from the top toolbar to create and create your legally-binding signature.

- Click DONE and save, print, and share or get the end {file.

Say goodbye to paper and other ineffective ways of completing your Preparer or other forms. Use our solution instead that includes one of the richest libraries of ready-to-customize forms and a powerful file editing services. It's easy and secure, and can save you lots of time! Don’t take our word for it, try it out yourself!

Related links form

When answering 'Are you exempt from withholding?', consider your tax situation carefully. If you expect to owe no tax or had no tax liability in the previous year, you may be able to check the exemption box. However, if your circumstances are different, it’s usually better to withhold to avoid any surprises. Referencing the MN DoR M4NP can provide clarity on your specific case.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.