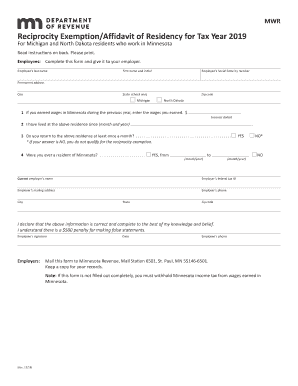

Get Mn Dor Mwr 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN DoR MWR online

How to fill out and sign MN DoR MWR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans choose to handle their own income tax returns and, in fact, to complete reports digitally.

The US Legal Forms online service aids in making the process of e-filing the MN DoR MWR quick and straightforward.

Ensure that you have accurately completed and submitted the MN DoR MWR on time. Take into consideration any relevant deadlines. If you provide incorrect information on your financial reports, it could lead to significant penalties and complications with your yearly tax return. Utilize only professional templates from US Legal Forms!

- Open the PDF template in the editor.

- Refer to the highlighted fillable sections. This is where you should enter your information.

- Select the option to choose when you encounter the checkboxes.

- Explore the Text tool along with other advanced features to edit the MN DoR MWR manually.

- Verify all the information prior to finalizing your signature.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your PDF form electronically and enter the date.

- Click on Done to proceed.

- Download or send the document to the intended recipient.

How to modify Get MN DoR MWR 2019: tailor forms digitally

Leverage the functionality of the feature-rich online editor while filling out your Get MN DoR MWR 2019. Utilize the assortment of tools to swiftly complete the fields and supply the required information promptly.

Preparing paperwork can be labor-intensive and costly unless you possess ready-to-use fillable templates to complete them digitally. The most efficient method to handle the Get MN DoR MWR 2019 is by using our expert and versatile online editing tools. We equip you with all the vital resources for quick document completion and enable you to modify your forms, customizing them to meet any specifications. Furthermore, you can annotate updates and leave messages for other involved parties.

Here's what you can accomplish with your Get MN DoR MWR 2019 in our editor:

Managing your Get MN DoR MWR 2019 in our robust online editor is the quickest and most efficient way to handle, submit, and distribute your documentation as required from any location. The tool functions from the cloud, enabling access from anywhere on any internet-enabled device. All forms you generate or complete are safely stored in the cloud, ensuring you can access them whenever necessary without the risk of loss. Stop squandering time on manual document completion and eliminate paper; conduct everything online with minimal effort.

- Fill in the empty fields using Text, Cross, Checkbox, Initials, Date, and Signature features.

- Emphasize crucial details with a selected color or underline them.

- Obscure sensitive information using the Blackout feature or simply delete it.

- Add images to illustrate your Get MN DoR MWR 2019.

- Substitute the original text with one that meets your needs.

- Leave comments or sticky notes to notify others about the updates.

- Create additional fillable sections and assign them to specific individuals.

- Secure the document with watermarks, incorporate dates, and bates numbers.

- Distribute the document in multiple methods and save it to your device or the cloud in various formats once you complete editing.

Related links form

Individuals not subject to withholding typically include those who earn below a certain income threshold and those classified as exempt by the MN DoR. Additionally, certain payments, like pensions or social security benefits, may also not require withholding. Being informed about your tax situation can help you manage your finances effectively. For a comprehensive understanding, consider using uslegalforms to explore your withholding status and options.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.