Get Mn Dor Mwr 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR MWR online

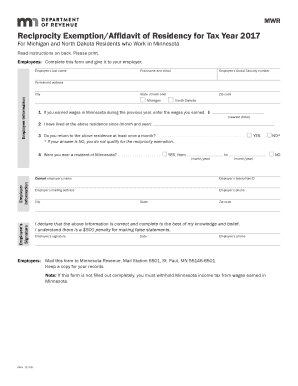

This guide provides clear and concise instructions on how to complete the MN Department of Revenue MWR form online. Designed for residents of Michigan and North Dakota working in Minnesota, the form helps claim an exemption from Minnesota income tax withholding.

Follow the steps to complete the MN DoR MWR form online.

- Click the ‘Get Form’ button to obtain the MN DoR MWR form and open it in your preferred editor.

- Enter the employee's last name, first name, and social security number accurately in the designated fields.

- Select your resident state (Michigan or North Dakota) by checking the appropriate box.

- Fill in your permanent address, including city, state, and zip code.

- In the income section, enter the total wages earned in Minnesota during the previous year.

- Indicate the month and year you have lived at your above-listed address.

- Answer whether you return to your permanent residence at least once a month. If NO, please note that you do not qualify for the exemption.

- If applicable, provide the dates for any previous Minnesota residency.

- Complete the employer's section by entering the current employer's name, federal tax ID, mailing address, and phone number.

- Sign and date the form to affirm the accuracy of the information provided. Include your phone number for contact purposes.

- Review the completed form for any missing information. Save your changes.

- Once confirmed, download, print, or share the form with your employer, ensuring they receive it by the deadline.

Complete your MN DoR MWR form online today to ensure timely processing and exemption from Minnesota income tax withholding.

Get form

Related links form

Minnesota has tax reciprocity agreements with several states, including North Dakota, South Dakota, and Wisconsin. This means residents of these states can avoid double taxation on income earned in Minnesota. To take advantage of these agreements, be sure to check the latest updates from the MN DoR MWR. Utilizing USLegalForms can assist you in understanding and applying these reciprocity rules effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.