Get Mn Dor St3 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN DoR ST3 online

How to fill out and sign MN DoR ST3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans are inclined to complete their own income taxes and additionally to submit reports digitally.

The US Legal Forms online platform assists in making the e-filing process of the MN DoR ST3 quick and convenient.

Ensure that you have accurately completed and submitted the MN DoR ST3 by the deadline. Be mindful of any due dates. Providing incorrect information on your financial documents can result in severe penalties and complications with your yearly tax return. Always use only reputable templates with US Legal Forms!

- Access the sample PDF in the editor.

- View the designated fillable fields. Here is where you can enter your information.

- Select the option if you see the checkboxes.

- Utilize the Text tool and other advanced features to manually modify the MN DoR ST3.

- Check all information thoroughly before proceeding to sign.

- Create your unique eSignature using a keypad, camera, touchpad, mouse, or smartphone.

- Authorize your online template electronically and indicate the specific date.

- Click on Done to proceed.

- Download or send the document to the recipient.

How to revise Get MN DoR ST3 2012: personalize forms online

Your swiftly editable and customizable Get MN DoR ST3 2012 template is at your fingertips. Utilize our collection featuring an integrated online editor.

Are you delaying the completion of Get MN DoR ST3 2012 because you simply don't know where to start and how to continue? We empathize with your concerns and have an excellent tool for you that is entirely unrelated to overcoming your procrastination!

Our online repository of ready-to-use templates allows you to explore and select from thousands of fillable forms tailored for a multitude of purposes and situations. However, obtaining the document is just the beginning. We furnish you with all the necessary tools to fill out, certify, and modify the document of your choice without exiting our website.

All you must do is open the document in the editor. Review the wording of Get MN DoR ST3 2012 and verify if it meets your expectations. Begin by adjusting the template using the annotation tools to give your document a more organized and polished appearance.

In conclusion, alongside Get MN DoR ST3 2012, you will receive:

With our professional tool, your finalized forms are generally officially binding and fully encrypted. We ensure the protection of your most sensitive information.

Acquire everything needed to generate a professionally appealing Get MN DoR ST3 2012. Make the right decision and explore our program today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, black out, and amend the existing text.

- If the document is intended for others as well, you can incorporate fillable fields and distribute them for others to complete.

- Once you’re done modifying the template, you can download the file in any available format or choose any sharing or delivery options.

- A comprehensive set of editing and annotation instruments.

- A built-in legally-binding eSignature solution.

- The capacity to create forms from scratch or based on the pre-designed template.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for securing your documents.

- A broad range of delivery options for simpler sharing and dispatching of documents.

- Adherence to eSignature regulations governing the use of eSignature in electronic dealings.

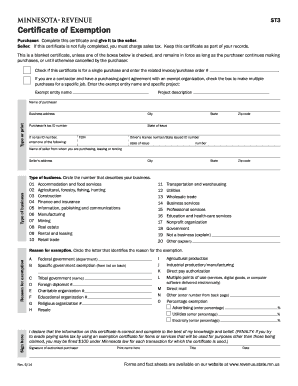

The ST3 tax form in Minnesota is a document used to claim sales tax exemption for eligible purchases. When completing an MN DoR ST3 form, you certify that you qualify for a sales tax exemption based on specific criteria. This form is essential for businesses and individuals making exempt purchases to avoid overpaying sales tax. Proper use of the ST3 form ensures compliance with Minnesota tax laws.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.