Loading

Get Mn M99 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN M99 online

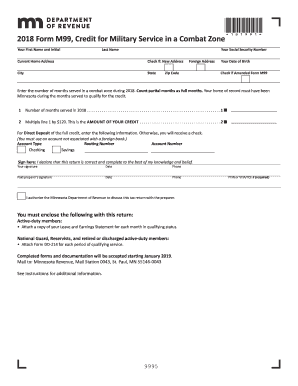

Filling out the MN M99 form is a crucial step for individuals seeking to claim tax credits for military service in a combat zone. This guide will provide you with clear, step-by-step instructions to complete the form online with ease.

Follow the steps to successfully complete your MN M99 form online.

- Press the ‘Get Form’ button to access the MN M99 form and open it in your preferred online editor.

- Enter your first name and middle initial in the designated fields, followed by your last name.

- Provide your social security number in the corresponding section.

- Fill in your current home address. If your address has changed, check the box indicating a new address.

- Complete the city, state, and zip code fields accurately.

- Enter your date of birth in the specified field.

- If applicable, check the box for an amended form.

- Input the total number of months served in a combat zone during 2018, counting partial months as full months.

- For direct deposit, provide your routing number, select the account type (checking or savings), and enter your account number.

- Sign and date the form, confirming that all information is correct to the best of your knowledge.

- If a paid preparer is used, their signature, date, and phone number should be included.

- Indicate if you authorize the Minnesota Department of Revenue to discuss this tax return with the preparer.

- Ensure to attach the required documentation specified for your eligibility.

- Save your changes, download a copy, and then print or share the completed form as needed.

Complete your MN M99 form online today to maximize your benefits!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The executor or administrator of an estate is responsible for filing a Minnesota estate tax return if the estate meets the required threshold. This responsibility usually falls on the individual designated to handle the estate's affairs. Understanding the MN M99 rules can simplify this process and ensure all necessary documents are submitted correctly. Consider using services like US Legal Forms for assistance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.