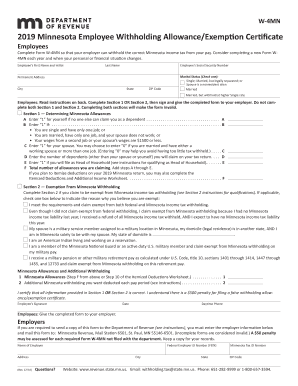

Get Mn W-4mn 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN W-4MN online

How to fill out and sign MN W-4MN online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Today, the majority of Americans choose to file their own income taxes and indeed, to fill out forms online.

The US Legal Forms internet service facilitates the task of submitting the MN W-4MN effortlessly and efficiently.

Ensure that you have filled out and submitted the MN W-4MN accurately by the deadline. Consider any timelines. Providing incorrect information in your financial documentation may lead to significant penalties and complications with your annual tax return. Utilize only approved templates from US Legal Forms!

- Open the PDF template in the editor.

- Look at the highlighted fillable sections. This is where you input your information.

- Select the option to indicate if you see the checkboxes.

- Navigate to the Text icon along with other advanced features to edit the MN W-4MN manually.

- Double-check every detail prior to signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your online template and provide the specific date.

- Hit Done to proceed.

- Download or forward the document to the intended recipient.

How to amend Get MN W-4MN 2019: tailor forms online

Streamline your document preparation process and modify it to your specifications within moments. Complete and validate Get MN W-4MN 2019 using a robust yet user-friendly online editor.

Creating documentation is always tedious, especially when you handle it sporadically. It requires you to meticulously follow all protocols and accurately fill in all fields with complete and precise information. Nonetheless, it frequently occurs that you need to modify the form or include additional fields to complete. If you need to revise Get MN W-4MN 2019 prior to submission, the optimal way to do so is by utilizing our powerful yet user-friendly online editing tools.

This comprehensive PDF editing tool permits you to swiftly and effortlessly finalize legal documents from any internet-enabled device, make minor alterations to the form, and add more fillable fields. The service enables you to designate a specific area for each type of data, such as Name, Signature, Currency, and SSN among others. You can make them compulsory or optional and determine who should fill in each field by assigning them to a specific recipient.

Our editor is a flexible, feature-rich online solution that can assist you in effortlessly and swiftly optimizing Get MN W-4MN 2019 along with other forms according to your needs. Enhance document preparation and submission efficiency and present your documentation professionally without difficulty.

- Open the required file from the directory.

- Complete the fields with Text and place Check and Cross tools next to the tickboxes.

- Utilize the right-side panel to modify the form with new fillable sections.

- Choose the fields based on the type of information you wish to gather.

- Set these fields as compulsory, optional, and conditional and tailor their sequence.

- Allocate each section to a specific individual using the Add Signer option.

- Verify that all necessary changes have been made and click Done.

If you claimed 0 on your MN W-4MN and still owe taxes, there might be several reasons for this. For instance, if you had additional income not subject to withholding or if your withholdings were insufficient to cover your total tax liability. It’s wise to regularly review your withholding status to ensure you are on track.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.