Get Mo 5095 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

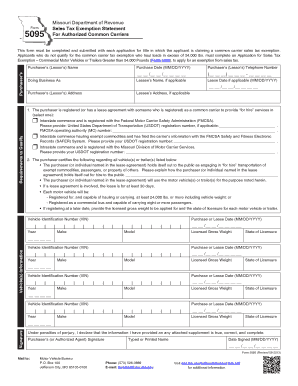

Tips on how to fill out, edit and sign MO 5095 online

How to fill out and sign MO 5095 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans choose to manage their own tax filings and, in actuality, to complete documents digitally.

The US Legal Forms online platform facilitates the task of completing the MO 5095 effortlessly and without stress. Now it might take no more than thirty minutes, and you can accomplish it from any location.

Ensure that you have completed and submitted the MO 5095 accurately and promptly. Consider any deadlines. Providing incorrect information in your financial documents can result in significant penalties and complications with your annual income tax return. Ensure you use only professional templates from US Legal Forms!

- Open the PDF form in the editor.

- Refer to the designated fillable fields. This is where you should enter your information.

- Select an option when you encounter the checkboxes.

- Utilize the Text tool and other advanced features to manually modify the MO 5095.

- Confirm every detail before proceeding to sign.

- Create your personalized eSignature using a keyboard, digital camera, touchpad, mouse, or mobile device.

- Authorize your document electronically and specify the exact date.

- Click Done to proceed.

- Save or send the document to the recipient.

How to modify Get MO 5095 2013: personalize forms online

Utilize our comprehensive online document editor to the fullest while preparing your forms.

Complete the Get MO 5095 2013, highlight the most important details, and seamlessly make any other necessary adjustments to its content.

Filling out documents digitally not only saves time but also allows you to modify the template according to your specifications. If you are set to manage the Get MO 5095 2013, think about finalizing it with our powerful online editing tools.

Our powerful online solutions are the easiest way to complete and alter Get MO 5095 2013 according to your needs. Use it to manage personal or business documents from anywhere. Open it in a browser, make any changes to your forms, and access them again in the future - they will all be safely stored in the cloud.

- Access the form in the editor.

- Input the required information in the blank fields using Text, Check, and Cross tools.

- Follow the document navigation to avoid missing any essential fields in the template.

- Circle some of the vital details and add a URL to it if necessary.

- Utilize the Highlight or Line options to emphasize the most important facts.

- Choose colors and thickness for these lines to present a polished form.

- Remove or obscure the details you wish to keep hidden from others.

- Replace portions of text that contain mistakes and input the information you require.

- Conclude modifications with the Done option when you are sure everything is accurate in the document.

To secure a no tax due letter in Missouri, you must confirm that all your tax obligations are settled. Reach out to the Missouri Department of Revenue and request a letter using the MO 5095 form. After providing the required details and verification of your account, the department will process your request. You will receive your no tax due letter via your preferred method of communication.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.