Loading

Get Mi 5076 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 5076 online

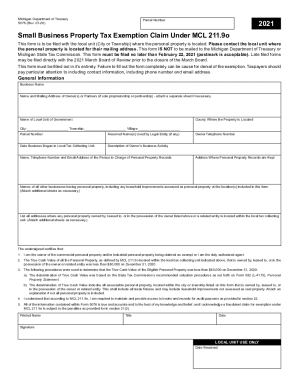

This guide provides a clear and comprehensive approach to completing the MI 5076 form online. It outlines the necessary steps and sections to ensure that users can successfully claim the Small Business Property Tax Exemption.

Follow the steps to accurately complete the MI 5076 form.

- Click ‘Get Form’ button to access the MI 5076 document and open it in the designated editor.

- Begin by entering the business name in the specified field, ensuring you provide the official name used during registration.

- Fill out the name and mailing address of the owner(s) or partners if applicable. If additional space is needed, attach a separate sheet.

- Indicate the name of the local unit of government where the personal property is located, specifying the city, township, or village.

- Enter the parcel number associated with the property, which is crucial for the local tax records.

- If applicable, list any assumed names used by the legal entity that owns the property.

- Provide the date business began operating within the local tax collecting unit.

- Describe the owner’s business activity clearly and concisely to help the local unit understand the business operations.

- Input the name, telephone number, and email address of the individual responsible for maintaining personal property records.

- Provide the owner’s telephone number and the address where personal property records are stored.

- List all other businesses that own personal property relevant to this exemption, including any leasehold improvements, ensuring clarity by attaching additional sheets if needed.

- Document all addresses where personal property owned by or in possession of the owner or a related entity is located. Use additional sheets if necessary.

- Review the certification statement and ensure that all conditions are met. This includes verifying the True Cash Value of all listed personal property.

- Sign and date the form, including the printed name and title to validate the submission.

- Once all fields are completed, save your changes, and choose to download, print, or share the form as required.

Complete your MI 5076 form online today to ensure your eligibility for the Small Business Property Tax Exemption.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In a business, all movable assets are termed personal property and are taxed annually. Additionally, some states tax personal property such as motor vehicles, boats and aircraft. Personal property excludes real property, which comprises of real estate, land and buildings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.