Loading

Get Mo Dor Mo-706 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-706 online

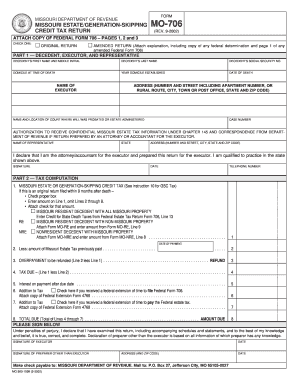

The MO DoR MO-706 is an essential document for filing estate and generation-skipping credit taxes in Missouri. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the MO DoR MO-706 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting whether this is an original return or an amended return. If it is an amended return, ensure to attach an explanation along with page 1 of any amended Federal Form 706.

- In Part 1, provide accurate information regarding the decedent, executor, and representative. Fill in the decedent’s first name, middle initial, last name, social security number, domicile at the time of death, year domicile was established, date of death, and the executor's name and address.

- Complete the details of the court where the will was probated or estate administered and the associated case number.

- If the return is prepared by an attorney or accountant, fill in the representative’s details, and include their signature, date, and telephone number to authorize receipt of confidential tax information.

- Proceed to Part 2 for tax computation. Indicate if this is the original return filed within nine months after death and check the appropriate box for completion.

- Enter the amount for the Missouri estate or generation-skipping credit tax on Line 1. Attach a check for this amount if required.

- Input any previously paid Missouri estate tax on Line 2. Calculate whether there is an overpayment or tax due based on the other lines provided.

- Finalize by signing the document. The executor and preparer, if applicable, must sign and date the return. Enter the address for correspondence.

- After completing all sections, save your changes and choose to download, print, or share the form as necessary.

Complete your documents online today to ensure a smooth filing process.

When filing your Missouri tax return, you will need to submit specific forms alongside your return. These forms may include your W-2s, schedules for any deductions, and other pertinent documentation. Ensuring that you have all necessary forms will help expedite the processing time with the Missouri Department of Revenue (MO DoR). For comprehensive guidance, consider resources from uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.