Loading

Get Mo Mo-1041 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-1041 online

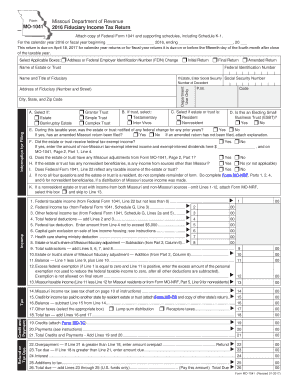

The MO MO-1041 is the 2016 fiduciary income tax return form used by estates and trusts in Missouri. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that you meet all necessary requirements.

Follow the steps to successfully complete the MO MO-1041 online.

- Click ‘Get Form’ button to obtain the form and open it in an accessible format online.

- Indicate the type of return by selecting applicable boxes regarding changes in address, initial return, final return, or amended return.

- Enter the name of the estate or trust and, if applicable, the decedent's social security number.

- Provide the fiduciary's name, title, and address, ensuring that all information is accurate and complete.

- Select the type of entity—estate or bankruptcy estate—and provide the federal identification number.

- If applicable, specify if the trust is a grantor, simple, or complex trust, and indicate whether it is testamentary or inter vivos.

- Designate the residency status of the estate or trust and whether it is an electing small business trust (ESBT).

- Answer questions regarding federal changes, tax-exempt income received, Missouri adjustments, and nonresident beneficiaries.

- Complete the income section by entering federal taxable income and related deductions, ensuring accuracy to avoid future discrepancies.

- Final calculations should be made in the tax section, determining the balance, credits, payments, and any refund or tax due.

- Review all entries for completeness and accuracy before saving your changes.

- Save changes, download a copy of the form, print it, or share it as needed.

Complete your forms online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If the estate or trust has no income, you may not need to file a 1041. However, sometimes it is beneficial to file for various reasons, such as maintaining records. Always evaluate the specific circumstances surrounding your estate or trust. Consulting our resources can help you decide the best approach regarding your MO MO-1041 obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.