Get Ms Dor 81-110 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR 81-110 online

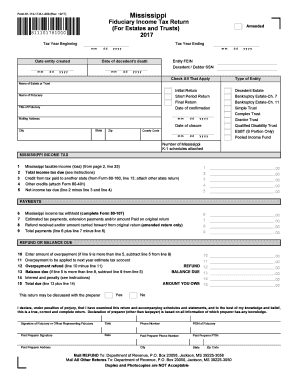

Filling out the MS DoR 81-110 form online can be straightforward with the right guidance. This expert guide will walk you through each section and field of the form, ensuring you understand the requirements and can submit your fiduciary income tax return accurately.

Follow the steps to complete the MS DoR 81-110 online.

- Click 'Get Form' button to begin the process of obtaining the form and open it in the editor.

- Indicate the tax year by filling in the 'Tax Year Beginning' and 'Tax Year Ending' fields with the appropriate dates.

- Provide the entity creation date and the date of the decedent's death in their respective sections, ensuring the format is mm/dd/yyyy.

- Select the type of entity by checking the applicable boxes for 'Decedent Estate,' 'Simple Trust,' 'Complex Trust,' among others.

- Complete the 'Name of Estate or Trust' section along with the 'Name of Fiduciary' and 'Title of Fiduciary' information.

- Enter the mailing address, including state, city, county code, and zip code for correspondence.

- Accurately fill out the 'Mississippi taxable income (loss)' field, referencing page 2 if necessary for calculations.

- Complete the total income tax due and any applicable credits by following the calculation steps outlined in the form.

- Finally, review the declaration statement for accuracy and add the signature of the fiduciary or authorized officer, along with the date.

- Once all fields are completed, you have the option to save changes, download, print, or share the form as needed.

Complete the MS DoR 81-110 online today to ensure your fiduciary income tax return is filed accurately and timely.

Get form

Related links form

To fill out a withholding allowance form, start by using the MS DoR 81-110 as a reference for accurate completion. Fill in your personal information and determine the number of allowances you are eligible to claim, based on your financial situation. Be sure to review your entries for accuracy before signing and submitting the form to your employer. This can optimize your tax withholding effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.