Loading

Get Nc D-410p 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC D-410P online

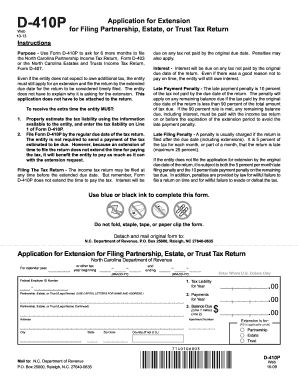

The NC D-410P form is used to request an extension for filing the North Carolina Partnership Income Tax Return or the North Carolina Estates and Trusts Income Tax Return. This guide provides detailed instructions on how to accurately complete the form online, ensuring you meet your filing requirements.

Follow the steps to successfully complete your NC D-410P application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the entity's legal name, address, and federal employer identification number in the specified fields. Use capital letters for ease of readability.

- On Line 1, input the estimated tax liability for the year. Partnerships should refer to Line 12 of Form D-403 for guidance, while estates or trusts should reference Line 8 of Form D-407. If no tax is anticipated, enter zero.

- In Line 2, record any tax paid by other entities, any North Carolina income tax withheld, and other relevant payments or credits expected to be shown on the return.

- Calculate the balance due by subtracting Line 2 from Line 1, and enter the result on Line 3.

- Select the type of entity for which the extension is requested by filling in the applicable circle (Partnership, Estate, or Trust).

- Review the completed form for accuracy. Ensure all fields are filled out correctly before submitting.

- After final review and confirmation of details, save the changes, download a copy, or print the form for your records and file it by mailing it to the North Carolina Department of Revenue at the provided address.

Get started with your NC D-410P application online today to ensure a timely filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

NC SIP stands for the North Carolina State Investment Plan. This program helps state employees and public school teachers save for retirement through managed investment options. Understanding the NC SIP can empower you to make informed decisions about your long-term financial future.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.