Loading

Get Nc Dor B-c-775 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR B-C-775 online

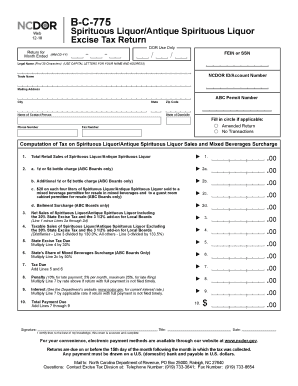

The NC DoR B-C-775 is the Excise Tax Return for Spirituous Liquor and Antique Spirituous Liquor. Filling out this form accurately is essential for compliance with North Carolina tax regulations. This guide provides step-by-step instructions to help you complete the form online with ease.

Follow the steps to complete the NC DoR B-C-775 online.

- Press the ‘Get Form’ button to access and open the NC DoR B-C-775 form in your preferred online editor.

- Fill in the FEIN or SSN field at the top of the form. Ensure you enter the correct identifier for your business.

- Provide the legal name in capital letters, filling in the first 35 characters. This should match your business name as registered.

- Enter your NCDOR ID or account number, followed by your trade name if applicable.

- Complete the mailing address fields, which include the street address, city, state, and zip code.

- Fill in the name of the contact person for the tax return and their phone number for future correspondence.

- If applicable, include the ABC permit number and state of domicile information.

- Indicate if this is an amended return or if there were no transactions by filling in the relevant circle.

- Proceed to the computation sections where you will enter sales data, follow the guidelines for each line item, including total retail sales and any applicable charges.

- Complete calculations for taxable sales, state excise tax due, and any penalties or interest, ensuring that you accumulate the final total payment due accurately.

- Sign and date the form, certifying that the information provided is complete and accurate.

- Once all sections are completed, save your changes. You can download, print, or share the form as needed.

Complete your NC DoR B-C-775 form online today to stay compliant with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When paying North Carolina state taxes, you should make your check payable to the North Carolina Department of Revenue. Ensure that you include any relevant account numbers or identifying information on your check. For a smooth process, refer to the guidelines found in the NC DoR B-C-775.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.