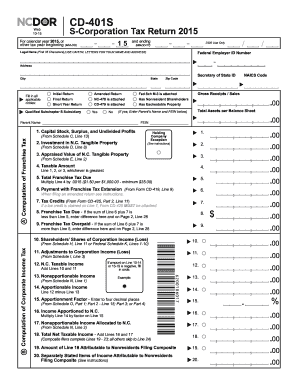

Get Nc Dor Cd-401s 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NC DoR CD-401S online

How to fill out and sign NC DoR CD-401S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans opt to handle their own tax returns and, in addition, to finalize documents in digital format.

The US Legal Forms online service facilitates the process of electronic filing for the NC DoR CD-401S, making it straightforward and convenient.

Ensure that you have accurately completed and submitted the NC DoR CD-401S by the deadline. Check any relevant timeline. Providing incorrect information in your financial reports may lead to significant penalties and complications with your annual tax return. Be certain to use only legitimate templates with US Legal Forms!

- Access the PDF template in the editor.

- Review the designated fillable spaces. Here, you can input your information.

- Select the option by checking the boxes that appear.

- Go to the Text icon and other advanced tools to manually modify the NC DoR CD-401S.

- Confirm all the details before you continue with signing.

- Create your unique eSignature using a keyboard, camera, touchpad, computer mouse or smartphone.

- Authenticate your online template and specify the date.

- Click on Done to proceed.

- Save or send the document to the intended recipient.

How to Modify Get NC DoR CD-401S 2015: Personalize Forms Online

Your quickly adjustable and tailored Get NC DoR CD-401S 2015 template is just a click away. Take advantage of our collection featuring an integrated online editor.

Do you delay finalizing Get NC DoR CD-401S 2015 because you simply aren't sure where to begin and how to move forward? We empathize with your concerns and have an excellent solution for you that has no relation to beating your procrastination!

Our online repository of pre-made templates allows you to browse and choose from thousands of fillable forms designed for various purposes and situations. However, acquiring the form is merely the beginning. We equip you with all the essential tools to fill out, sign, and modify the document of your preference without ever leaving our site.

All you need to do is to open the document in the editor. Review the wording of Get NC DoR CD-401S 2015 and verify whether it's what you’re seeking. Start filling out the form by using the annotation tools to give your form a more structured and tidier appearance.

In conclusion, alongside Get NC DoR CD-401S 2015, you'll receive:

- Add checkmarks, circles, arrows, and lines.

- Emphasize, conceal, and amend the existing text.

- If the document is intended for additional users, you can incorporate fillable fields and share them for others to complete.

- Once you’ve finished completing the template, you can obtain the document in any available format or select any sharing or delivery options.

- A robust suite of editing and annotation tools.

- An integrated legally-binding eSignature feature.

- The capability to create forms from scratch or based on the pre-prepared template.

- Compatibility with various platforms and devices for added convenience.

- Numerous choices for securing your files.

- A variety of delivery options for smoother sharing and sending out documents.

In North Carolina, all corporations, including S Corps, are required to file an annual report. This keeps your business in good standing and informs the state about your operations. Understanding the role of the NC DoR CD-401S is vital for ensuring compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.