Loading

Get Nc Dor Cd-401s 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR CD-401S online

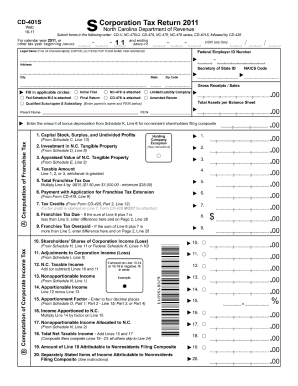

Filling out the NC DoR CD-401S form online can be a straightforward process when guided properly. This document provides a comprehensive guide to help you understand each section of the form, ensuring accurate completion for your corporation's tax return.

Follow the steps to successfully complete your NC DoR CD-401S form.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Enter the legal name of your corporation in uppercase letters, ensuring it fits within the first 35 character limit. Include your Federal Employer ID Number and address details next.

- Complete the fields for your Secretary of State ID, city, state, and zip code. You will also need to input your NAICS code and gross receipts or sales.

- Indicate whether you are an initial filer, final return, amended return, or if you have attached forms NC-478 or CD-479. Check the applicable circles provided.

- Provide information about your corporation's tax computations including franchise tax calculations. Ensure you enter amounts accurately based on previous schedules.

- Fill in sections related to corporate income tax, including any adjustments to income. Carefully follow instructions to ensure proper filing.

- Review the shareholders’ shares of income and deductions carefully. You can add or attach additional pages if necessary.

Complete your NC DoR CD-401S form online today for accurate and efficient submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To mail your NC CD 405, you should send it to the address specified on the form itself or the North Carolina Department of Revenue’s website. Ensure that your mailing is accurate and includes all necessary documentation. Timely submission helps you avoid fines and keeps your business compliant. Having guidance on forms like the NC DoR CD-401S can further assist in this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.