Loading

Get Nc Dor D-400 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-400 online

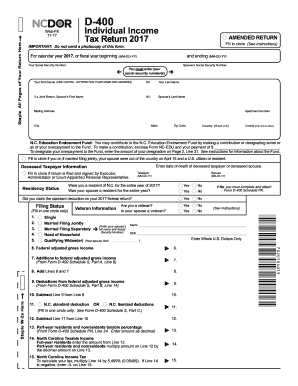

The NC DoR D-400 is an important form for individual income tax returns in North Carolina. This guide will walk you through each component of the form to ensure a smooth and accurate filing process.

Follow the steps to fill out the NC DoR D-400 online

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling in your personal information including your first name, middle initial, last name, and your social security number, ensuring that all entries are in capital letters as instructed.

- If filing a joint return, similarly fill in your spouse’s first name, middle initial, and last name along with their social security number.

- Provide your complete mailing address, including city, state, zip code, and country if applicable, alongside your county abbreviated to the first five letters.

- Indicate if you or your spouse were out of the country on April 15 by filling in the appropriate circle.

- For residency status, confirm if you and your spouse were residents of North Carolina for the entire year.

- Select your filing status by filling in one circle only: Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er).

- Complete the tax calculation fields by filling out federal adjusted gross income and deductions, filling in the corresponding lines.

- Calculate your North Carolina taxable income using the instructions provided and fill in the appropriate total.

- Ensure that you fill in your tax credits and combine all relevant lines as directed, marking any consumer use tax if applicable.

- Finalize by signing the form. If you are filing jointly, both partners must provide their signature and dates. Include the necessary preparer information if applicable.

- Save your changes, and you can then download, print, or share the completed form as needed.

Start completing your NC DoR D-400 online today for a seamless tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can file your NC D-400 form electronically or by mail, depending on your preference. If you choose to mail your return, send it to the appropriate address provided by the NC Department of Revenue. Using an online platform can simplify this process and help you submit your NC DoR D-400 efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.