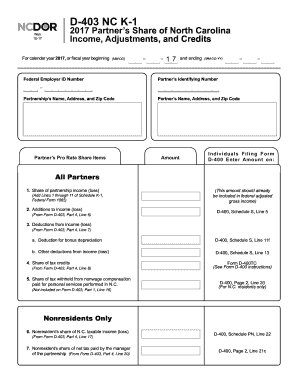

Get Nc Dor D-403 K-1 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NC DoR D-403 K-1 online

How to fill out and sign NC DoR D-403 K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans choose to handle their own tax filings and, furthermore, prefer to fill out documents in digital format.

The US Legal Forms online service facilitates the submission of the NC DoR D-403 K-1, making it straightforward and hassle-free.

Ensure that you have accurately completed and submitted the NC DoR D-403 K-1 by the specified deadline. Be mindful of any time limits. Providing incorrect information in your financial statements can result in substantial penalties and complications with your annual tax filing. Only utilize official templates from US Legal Forms!

- Examine the PDF template in the editor.

- Look at the indicated fillable fields. This is where you will input your details.

- Select the checkbox options if they are visible.

- Proceed to the Text icon and utilize other effective tools to manually tailor the NC DoR D-403 K-1.

- Verify all the information before you proceed with signing.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your document online and indicate the exact date.

- Click Done to continue.

- Save or forward the document to the intended recipient.

How to alter Get NC DoR D-403 K-1 2017: personalize forms online

Enjoy a hassle-free and digital method of amending Get NC DoR D-403 K-1 2017. Utilize our dependable online tool and conserve significant time.

Creating every document, including Get NC DoR D-403 K-1 2017, from the ground up requires excessive effort, so having a reliable source of pre-prepared document templates can greatly enhance your efficiency.

However, adjusting them may pose difficulties, especially with documents in PDF format. Luckily, our extensive library offers a built-in editor that enables you to swiftly complete and modify Get NC DoR D-403 K-1 2017 without leaving our platform, so you don’t have to squander hours processing your forms. Here’s what you can do with your file using our tools:

Whether you need to execute modifiable Get NC DoR D-403 K-1 2017 or any other document listed in our collection, you’re on the right track with our online document editor. It’s straightforward and secure and doesn’t require you to possess specialized skills. Our web-based tool is crafted to manage nearly everything you can consider related to document editing and execution.

Move away from the traditional approach of handling your documents. Choose a more effective alternative to assist you in simplifying your tasks and making them less reliant on paper.

- Step 1. Find the necessary document on our platform.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Take advantage of expert modification features that allow you to insert, delete, annotate, and highlight or obscure text.

- Step 4. Create and add a legally-recognized signature to your document by using the sign option from the upper toolbar.

- Step 5. If the document’s arrangement doesn’t meet your requirements, use the options on the right to delete, add, and organize pages.

- step 6. Include fillable fields so other individuals can be invited to complete the document (if necessary).

- Step 7. Distribute or send the form, print it, or select the format in which you wish to download the document.

Related links form

Yes, you can file NC state taxes electronically, including forms like the NC DoR D-403 K-1. E-filing is often quicker and more efficient, allowing you to submit your information securely. This method also helps to expedite any potential refunds and provides confirmation of your filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.