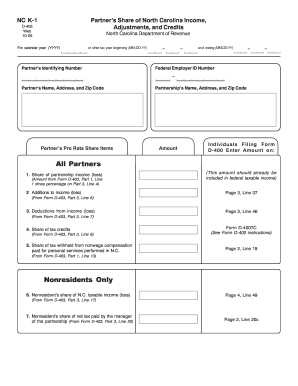

Get Nc Dor D-403 K-1 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NC DoR D-403 K-1 online

How to fill out and sign NC DoR D-403 K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

In recent times, the majority of Americans choose to handle their own taxes and, in addition, to finalize reports electronically.

The US Legal Forms online platform simplifies the task of submitting the NC DoR D-403 K-1 swiftly and conveniently.

Ensure that you have accurately completed and submitted the NC DoR D-403 K-1 on time. Consider any relevant deadlines. Providing inaccurate information on your tax documents can lead to serious penalties and complications with your annual tax return. Be certain to use only official templates from US Legal Forms!

- Access the PDF template in the editor.

- Review the designated fillable sections. Here you can enter your details.

- Select the option based on your preferences if you encounter the checkboxes.

- Utilize the Text tool and other robust features to manually modify the NC DoR D-403 K-1.

- Examine every piece of information before you proceed with signing.

- Create your unique eSignature using a keyboard, camera, touchpad, computer mouse, or mobile device.

- Authenticate your online template electronically and indicate the date.

- Click Done to proceed.

- Save or send the document to the intended recipient.

How to modify Get NC DoR D-403 K-1 2005: personalize forms online

Forget the outdated method of handling Get NC DoR D-403 K-1 2005 on paper. Have the document completed and validated promptly with our expert online editor.

Are you required to update and finish Get NC DoR D-403 K-1 2005? With a professional editor like ours, you can achieve this in just a few minutes without needing to print and scan documents back and forth. We offer fully editable and uncomplicated document templates that will act as a foundation and assist you in completing the necessary document template online.

All files, by default, include fillable fields that you can execute as soon as you access the form. However, if you wish to enhance the current content of the form or introduce new elements, you can select from various customization and annotation options. Emphasize, obscure, and annotate the text; insert checkmarks, lines, text boxes, graphics, and notes as well as comments. Furthermore, you can quickly validate the form with a legally-binding signature. The finalized form can be shared with others, stored, imported into external applications, or transformed into any widely-used format.

You’ll never go wrong utilizing our web-based tool to execute Get NC DoR D-403 K-1 2005 because it’s:

Don't waste time processing your Get NC DoR D-403 K-1 2005 in an obsolete manner - using pen and paper. Utilize our fully equipped solution instead. It provides you with an extensive array of editing features, integrated eSignature options, and convenience. What sets it apart from similar alternatives is the team collaboration functionality - allowing you to work on forms with anyone, establish a well-organized document approval process from A to Z, and much more. Experience our online solution and obtain the best value for your investment!

- User-friendly and simple to operate, even for individuals who have not completed paperwork online previously.

- Robust enough to accommodate various editing requirements and document types.

- Safe and secure, ensuring your editing experience is protected each time.

- Accessible across different devices, facilitating completing the document from anywhere.

- Capable of generating forms based on pre-drafted templates.

- Compatible with multiple file formats: PDF, DOC, DOCX, PPT, and JPEG, among others.

Related links form

Yes, income shown on Schedule K-1 is taxable, as it is considered passthrough income from the partnership or S corporation. This income must be reported on your personal tax return, impacting your overall tax liability. It's important to understand how to include the K-1’s amounts in conjunction with your NC DoR D-403 K-1 reporting. For more support navigating these complex situations, uslegalforms offers helpful resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.